BHP to Exit US Shale Assets

BHP chief executive Andrew Mackenzie has said the Australian miner has judged that all its US shale interests are "non-core" and are to be "exited."

However it won't be a fire-sale, he said in the company's results for the 12 months to June 2017.

"As I have said previously, the shale acquisitions were poorly timed, we paid too much and the rapid pace of early development was not optimal. When we entered the industry our objective was to leverage our systems and scale, become an industry leader, and then replicate the opportunity around the world. However....it became apparent that opportunities to replicate US shale oil elsewhere did not exist," he said.

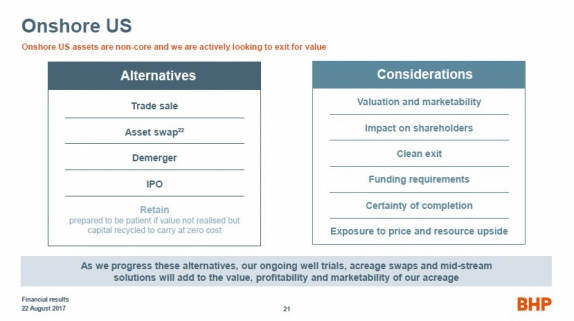

"Since then, we quickly improved our capability and significantly lowered investment levels. We also reduced our footprint through divestments and optimised our remaining position through a number of acreage trades and swaps. This sharpened focus informed our regular portfolio review and we have now concluded that these assets are non-core. With extensive input from independent advisers, we are pursuing options (several of which are outlined on this slide) to exit our quality acreage. However, all options will take time," added Mackenzie.

Slide from BHP full year presentation (Photo credit: BHP Billiton)

"We will be disciplined and use this time productively to maximise the value of this acreage through: larger completions; acreage consolidation; a midstream solution in the Permian; gas hedging in the Haynesville; and further well tests to assess prospective resource across all fields. We will be guided by value. We know what the acreage is worth in our hands and are prepared to be patient," he concluded.

The company holds more than 838,000 net acres in four major US shale areas – Eagle Ford, Permian, Haynesville and Fayetteville – where we produce oil, condensate, gas and NGLs. The Black Hawk area of Eagle Ford and the Permian area are its two largest liquids-focused field developments.

BHP said that, despite an overall mild winter in the US, the domestic US gas price strengthened in the 12-months to June 2017 on strong power demand, rising exports and lower year on year production, and were likely to remain supported in the near-term. But in the longer-term, despite strong demand, it said the sheer abundance of US gas supply might cause prices to ease.

Woodside-operated expansion of offshore NW Shelf fields to maintain LNG output long-term was 47%-complete and on target to finish in 2019, BHP said. It has a 16.7% interest. In Australia, a Bass Strait 400mn ft3/d gas process plant at Longford was completed May 2017 in which BHP's non-operating stake is 50%. BHP net profit for the year to June 2017 was US$6.22bn (versus a year-ago $6.21bn loss), helped by higher commodity prices.

Mark Smedley