Baker & McKenzie Report on Shale Gas in the UK

1. Introduction

The UK has technically recoverable shale gas reserves estimated at 26 trillion cubic feet ("tcf") and technically recoverable shale oil around 0.7 billion barrels.[1] Although these reserves are significantly less than those of other major oil and gas producing nations that also have significant unconventional hydrocarbon resources, such as Algeria (707 tcf), Argentina (802 tcf) and Australia (437 tcf), it is hoped that the UK may enjoy a US-style shale gas revolution. Such a revolution would enable the country to decrease its reliance on oil and gas imports for energy generation.

2. Challenges

The UK industry is facing some problems, including mature fields nearing decommissioning (leading to decreased production), increased levels of health and safety regulations and a rise in the taxation of profits from oil and gas since 2011. Shale gas development has also struggled with a lack of public support in the UK.

In a move to increase investment in shale gas, the UK government has created a package of incentives for both the public and investors. This package includes:

- a new shale gas tax regime which features an 'onshore pad allowance', reducing the headline tax rate from 62% to 30% for a portion of profits; and

- a promise that councils can keep 100% of the local taxes, known as business rates, that they collect from shale gas sites – double the current 50% figure. This is in addition to community benefits agreed with the industry of £100,000 per well fracked and a further 1 % of revenues if shale gas is discovered.

However, a US-style shale gas revolution still looks unlikely owing to the cost of technology, the location of shale basins in densely populated areas, competition from imported oil and gas and heavily subsidised renewable energy. Most significantly, exploration and exploitation is still at a very early stage with no wells commercially producing shale gas to date.

3. Regime applicable to shale gas projects

Generally speaking, exploration and exploitation of unconventional hydrocarbon resources is regulated by the same regime that applies to conventional resources under the Petroleum Act 1998 ("PA"). Under the PA, rights to all mineral resources are vested in the Crown and companies must obtain a Petroleum Exploration and Development Licence ("PEDL") from the Secretary of State of Energy and Climate Change in order to search, bore for and get petroleum or natural gas.

The exploration term under a PEDL is 11 years, comprised of 6 years exploration and 5 years appraisal. The relinquishment requirement is 50% at the end of the 6 year exploration period. The exploitation term is 20 years, which can be extended if production is continuing.

The UK regime does not impose a compulsory state participation. There is no national oil corporation in the UK and oil and gas developments are carried out through international oil corporations ("IOCs"). The government derives revenues from taxes on such developments.

The Department of Energy and Climate Change ("DECC") published a "regulatory roadmap" for gas exploration in December 2013. This roadmap addresses:

- environmental consents;

- DECC consents;

- planning permission; and

- landowner consents.

4. Regulation of shale gas operations

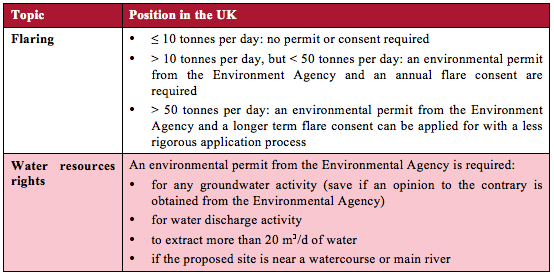

Two of the most important issues for a shale gas development are:

- the access to sufficient water quantities to enable fracking operations; and

- the ability to flare gas in order to test the commerciality of a play.[2]

In the UK, these issues are addressed as follows:

In addition to these issues, domestic market obligations, third party access to infrastructure and the tax regime will have to be considered.

5. Key shale gas basins

The EIA identified the following basins as having technically recoverable shale gas resources in the UK:

.png)

6. Market update

To date, Cuadrilla and IGas are the only IOCs to have commenced exploratory drilling in the UK (both in the Bowland shale play). A number of other IOCs have licence interests but have not progressed beyond desktop study:

- Cuadrilla in the Balcombe play;

- Centrica, Celtique Energy and GDF Suez in the Bowland play;

- Celtique Energy, Dart Energy, Egdon Resources, IGas, Ecorp International and Total in the Gainsborough play; and

- Celtique Energy and Eurenergy in the Weald play.

On 13 January 2014, Total became the first major oil and gas company to invest in the UK. It acquired a 40% interest in two exploration licences in Lincolnshire.

In February 2014, Cuadrilla announced at its Roseacre Wood and Preston New Road sites (both in Lacashire) its intention to apply for planning permission to drill, hydraulically fracture and test the flow of gas from four new exploration wells. While Cuadrilla has pulled out of its Banks shale gas site in March 2014, it is now applying to the county council for an extension to its current planning permission at Becconsall well, near Banks.

On 2 April 2014, IGas announced that it has found shale gas at Barton Moss (Eccles). It will take up to 6 months to analyse the samples.

Nebula Resources, a company run by Dr Chris Cornelius (one of Cuadrilla's founders), is planning to undertake shale in gas operations in the Irish Sea. It has been granted three licences by DECC. [3] The area covered by these licences reportedly stretches west from Blackpool into Morecambe Bay, over areas located less than 100 miles from Dundalk. This is the first offshore shale gas project in the world.

Although commercial extraction has not yet started in the UK, DECC has awarded a total of 334 landward licences for onshore petroleum and gas exploration[4], a number of which were granted over prospective shale plays. The 14th onshore licensing round for PEDLs is expected to take place in 2014, once the DECC's consultation process to determine over which areas licences could be granted closes.[5]

7. Political update

Shale gas operations in the UK have been stalled by public protests over the environmental impact of fracking. However, Prime Minister David Cameron has recently stated that the UK is "going all out for shale", and indeed the UK government has demonstrated its support of shale gas production on a number of occasions. For example, the UK government has proposed reforms to the planning regime for onshore gas exploration. This would include the removal of the current requirement to notify landowners of planning applications where only underground operations will take place under their land. The UK government is also considering reforming trespassing laws to enable shale gas operators to drill legally without obtaining the consent of the landowner.[6] Legislation to this effect is expected to be announced in the Queen's Speech on 3 June 2014.

The annexation of Crimea by Russia has encouraged the UK, as well as the EU and many of its member states, to search for ways to reduce dependence on imports from Russia's OAO Gazprom (OGZD), the main supplier of gas to Europe. In March 2014, David Cameron said that energy independence and the production of shale gas should top Europe's political agenda and suggested the shale gas reserves in South-eastern Europe, Poland and the UK could be a means to decrease dependence on Russia.

Normally, it takes approximately five to ten years to find out whether shale is commercially viable. However, Cuadrilla's chief executive, Francis Egan, stated on 1 April 2014 that, should the Ukraine crisis worsen dramatically, and should Britain declare a state of national emergency thereby removing all constraints on shale developments, it would take two to four years to get up to appreciable production rates.

8. Further information

For further information please see Baker & McKenzie's Shale Gas, an International Guide which provides a regional examination of shale gas operations and offers a unique analysis of local law and key contractual issues in ten "Hot Countries" for shale gas projects: Algeria, Argentina, Australia, China, Poland, Russia, South Africa, United Kingdom, Ukraine and the United States. For a copy please contact Michelle Brown or visit www.bakermckenzie.com.

[1] See Energy Information Administration ("EIA") June 2013 report on shale gas resources.

[2] For a detailed discussion of these issues and other key issues to consider for a shale gas project (such as domestic market obligations, tax regime etc), please refer to Baker & McKenzie's Shale Gas, an International Guide, available at: http://bakerxchange.com/s/b2615bd9d0f8864856b07a97d198ce09cd00f762

[3] These licences cover blocks: 110/46, 110/9 and 110/10.

[4] 97 PEDLs were awarded in the 13th onshore licensing round in 2008.

[5] The consultation process is currently scheduled to close on 28 March 2014.

[6] Currently under UK law, licensees must obtain consent from the landowner for vertical drilling and the consent from any landowners under whose land there will be horizontal drilling. Failure to do so will amount to trespass.