Woodside To Raise Capital, Buy Exxon's Scarborough Stake

Australian oil and gas major Woodside Energy has launched a A$2.5bn ($1.97bn) equity raising, with the funds intended to be used to boost its stake and develop assets in Western Australia and aid with its project in Senegal, the company said February 14.

“The Entitlement Offer provides equity funding for Scarborough and SNE-Phase 1, and supports progression of Browse to targeted FID [final investment decision]. These projects are a continuation of our previously announced strategy of unlocking the Burrup Hub and developing oil in West Africa,” Woodside CEO Peter Coleman said.

“The acquisition of the additional interest in Scarborough provides greater alignment, control and certainty over a low-cost, high value opportunity ahead of a global LNG supply gap,” he said.

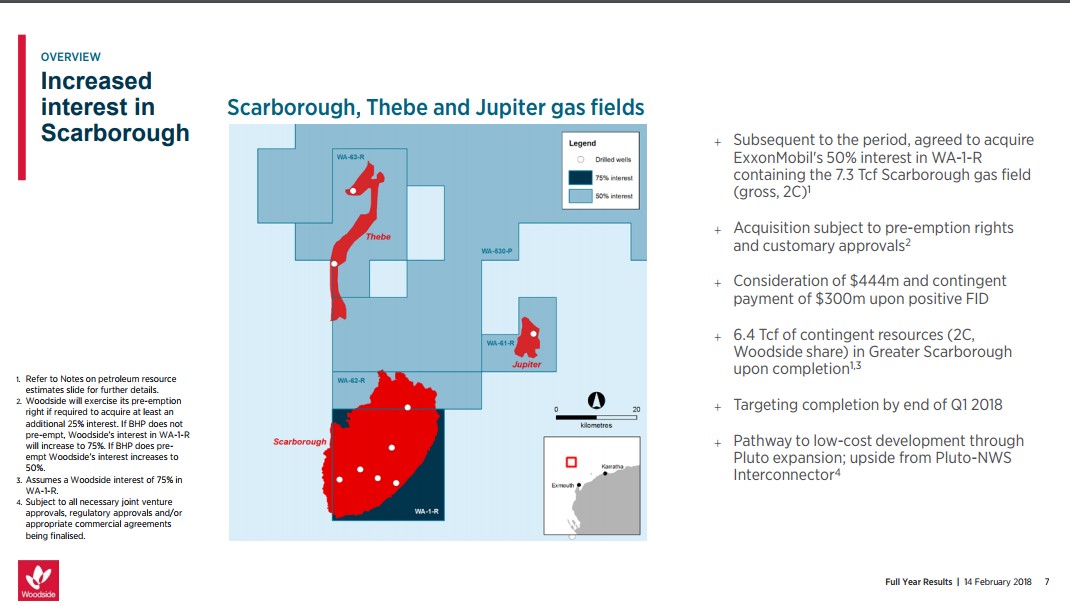

The company entered into a binding sale and purchase agreement to purchase ExxonMobil’s 50% interest in WA-1-R, which contains the Western Australian 7.3 trillion ft3 Scarborough gas field on the day of announcing the equity raising, which will take Woodside’s interest to 75%. The transaction is targeted to be completed in the current quarter. Woodside said it will pay A$744mn (US$585mn) for the stake, made up of A$444mn on completion, plus a contingent payment of A$300mn upon a positive FID in the project. The deal is subject to pre-emption rights by BHP Billiton, which holds the other 25% Scarborough interest. If completed, Woodside’s net share of the contingent resources (2C) in Scarborough would rise from 2.8 trillion ft3 of dry gas to 6.4 trillion ft3, the company said.

Woodside said that the acquisition is expected to create a pathway to develop the field (see its slide below) and a lower-cost brownfield expansion of its Pluto LNG facility, in which the company holds a 90% interest.

The Browse Joint Venture – which Woodside has a 30.6% interest in – is targeting commencement of the concept definition phase and to align commercial requirements with the North West Shelf Project in 2H2018. It’s planned to be FID-ready in 2021.

The money is also intended to be used to help with the development of the SNE Field Phase 1 oil project, in which Woodside has a 35% interest offshore Senegal.

Woodside recorded a full-year 2017 reported net profit after tax of A$1,024 mn. Production was 84.4mn barrels of oil equivalent, and sales revenue was $3.62bn.

It said its equity LNG production in 2017 was 61.7mn barrels of oil equivalent, and that its guidance for 2018 is 69-71mn boe, and that its guidance for 2018 is 85-90mn boe inclusive of a higher contribution from Wheatstone LNG. The company also said its average realised prices from LNG projects in 2017 were: A$38/boe for Northwest Shelf (up 15%), A$47/boe for Pluto LNG (down 2%), and A$48/boe for Wheatstone which started up last year. Woodside's pipeline gas sales in Australia realised A$20/boe in 2017, down 5%.

Woodside's total 2017 equity production (including its LNG) was 84.4mn boe (231,200 boe/d), and its guidance for 2018 is 85-90mn boe.

Update 1.25pm UK time: ExxonMobil has confirmed that it has reached an agreement with Woodside Energy Limited to sell Esso Australia's participating interest in the Scarborough WA-1-R retention lease. "Subject to regulatory and government approvals, the transaction is expected to close by April 2018," it told NGW. The US supermajor said it will work with its co-venturers to ensure a smooth transition, and that no Esso employees will be impacted as a result of this transaction. "We remain committed to our Australia operations and to ensuring the safe and reliable delivery of oil and gas to our customers. ExxonMobil Australia will maintain its presence as one of Australia's major producers of natural gas and crude oil." It is also an oil refiner and product marketer in Australia.

Slide from Woodside's 4Q2017 results presentation relating to its proposed acquisition of ExxonMobil's 50% stake in the Scarborough gas field (Credit: Woodside)