Asia’s LNG demand to resume upward trajectory post-2023 [Gas in Transition]

Asian LNG demand has underwhelmed so far in 2023, after a lacklustre 2022, but structural growth in the region’s LNG import capacity, backed by investment in transmission and distribution infrastructure is strong. New countries are entering the market, China’s regasification capacity is expanding rapidly, while India remains committed to boosting substantially gas’ share of the energy mix at the expense of coal.

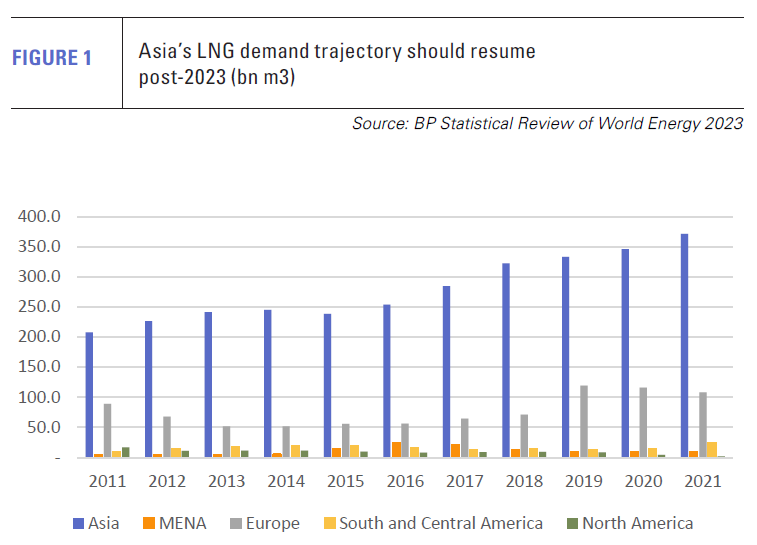

As a result, Asian LNG demand should return to growth but is also shifting towards more price-sensitive and less creditworthy markets (see figure 1).

Two countries in the region have or are about to receive their first LNG cargoes. In April, the Philippines saw the arrival of LNG carrier Golar Glacier, which delivered a commissioning cargo for the country’s first LNG terminal located in Batangas Bay near Manila. The terminal has a capacity of 3mn mt/yr and is expected to be followed by a second floating storage and regasification unit (FSRU) also in Batangas this year, adding a further 5mn mt/yr of capacity.

Developer First Gen Corp, which owns four gas-fired power plants with capacity of 2 GW, expects to receive the commissioning cargo for the second FSRU in September and put in place a medium-to-long term supply deal from the start of 2024.

The two FSRUs, two of seven approved LNG projects in the country, will provide gas for existing and new power plants as domestic gas resources, primarily from the Malampaya gas field, decline. The field is expected to run dry sometime between 2024 and 2027, although a new operating contract for the field was signed in May. New drilling could extend the field’s lifetime, but production is unlikely to return to the levels of the past.

Meanwhile, following a long and convoluted path to market entry, Vietnam has announced the completion of its first LNG import facility, Thi Vai, and received authorisation from the ministry of trade and industry for its first imports. A tender was launched in late April to secure a commissioning cargo for the terminal which starts with a capacity of 1mn mt/yr. Operator PetroVietnam Gas intends to expand capacity to 3mn mt/yr in coming years.

The terminal’s primary function is to import gas for two under-construction gas-fired power plants, Nhon Trach 3 and 4 with a combined capacity of 1.5 GW. Two other gas-fired power sites will add to LNG demand, given the country’s declining domestic gas output, both of which are slated for start-up by 2025, the 1.2-GW Hiep Thuoc-1 plant and the 0.8-GW Bac Lieu plant.

Debate continues within Vietnam as to how much LNG the country will need. It appears likely to fall short of the 30mn mt/yr once projected, but will still represent a substantial addition to the demand side of the LNG market. The government is targeting renewables and gas in the period to 2035 as the primary means of reducing the country’s intensive coal use.

Debate continues within Vietnam as to how much LNG the country will need. It appears likely to fall short of the 30mn mt/yr once projected, but will still represent a substantial addition to the demand side of the LNG market. The government is targeting renewables and gas in the period to 2035 as the primary means of reducing the country’s intensive coal use.

Electricity from coal-fired generation grew from 19.9 TWh in 2011 to 114.1 TWh in 2021, largely the result of new coal plant construction financed by international lenders, an option which has been sharply curtailed. The government’s adoption of a net zero carbon target by 2050 necessitates significant curbs in coal use. LNG is expected to fill that gap on a transitory basis at least.

In the renewables sector, Vietnamese solar generation is growing strongly, jumping from 10.9 TWh in 2020 to 25.8 TWh in 2021 and the country holds significant potential for offshore wind. Solar generation may be variable, but it is nicely aligned with the demand profile of the country’s large manufacturing sector.

Bangladesh signs long-term supply deal

Despite severely limiting LNG purchases in 2022 as a result of a dearth of affordable bids, recent market volatility and its current energy crisis does not appear to have deterred Bangladesh from its focus on LNG.

Of particular importance was the announcement in early June of a new long-term supply contract with Qatar, starting from 2026. The deal is between state company PetroBangla and QatarEnergy for 1.8mn mt/yr of LNG over 15 years. The long-term deal should better insulate Bangladesh from spot market price volatility, providing it with more security for the expansion of its LNG imports.

Moreover, PetroBangla announced plans for the construction of three new LNG import terminals earlier this year, which together are expected to have capacity of between 15.5-23mn mt/yr. The country currently has two FSRUs in operation at Moheshkhali each with a capacity of 5bn m3/yr (3.7mn mt/yr). The new terminals are planned for Payra in the country’s southwest, Matarbari in the southwest and an additional facility at Moheshkhali.

Bangladesh is in the grip of its worst energy crisis in decades. Hot weather has sent electricity demand spiralling and several major power plants have been forced to curtail or suspend generation, owing to a lack of fuel, including coal. Like Vietnam, domestic gas production has stalled, but power demand continues to rise rapidly. Unlike Vietnam, Bangladesh’s renewable energy deployment remains very limited.

China: woke giant continues to stretch

China has been the largest single source of LNG demand growth over the last decade and will continue to play a leading role in the next. However, the much-predicted bounce back in demand this year, following the lifting of its zero tolerance COVID-19 policies has not so far been realised, although LNG imports were higher year on year in March, April and May. High prices for spot LNG emphasise the marginal role the fuel plays in the Chinese energy mix.

A key reason why Chinese demand for LNG has not jumped is that the ending of its restrictive pandemic policies has not been accompanied by a rebound in economic activity. China’s manufacturing purchasing managers index dropped in May to 48.8, down from 49.2 in April – a reading below 50 implies contraction. Factory gate inflation in May fell 4.6% year on year, again indicating very challenging economic conditions for Chinese manufacturers.

Moreover, Chinese industry cannot expect to gain a big boost from export orders as growth slows elsewhere in the world economy and particularly in the advanced economies. In April, the International Monetary Fund predicted that growth in the advanced economies would drop to just 1.3% this year from 2.7% in 2022.

In addition, while spot LNG prices in the Asia-Pacific market, as represented by the Japan-Korea Marker, have fallen to around $9/mn Btu, they are not particularly low for the summer season and should firm up over the winter period. As a result, and in addition to increased competition from coal, renewables and pipeline gas, Chinese LNG imports are unlikely to return to peak levels this year.

However, at the same time, China’s coal-to-gas switching plans are likely to regain impetus as gas supply improves. The country continues to build new regasification capacity at a fast rate with more companies entering what has become a more domestically-open market. Zhejiang Energy Group, for example, will start commissioning operations at its 3mn mt/yr regasification terminal in Wenzhou in June. This is the provincial company’s first such facility.

In addition to terminals under construction, the government last year approved four new projects, Jiangsu Huadian Ganyu LNG, Huizhou LNG, Putian LNG and Yingkou LNG. Together the four facilities will have a combined import capacity of just over 20mn mt/yr. Construction of the 3mn mt/yr Jiangsu Huadian Ganyu terminal started in February. The prime movers behind the projects are all power companies rather than Chinese state oil and gas companies.

In addition to terminals under construction, the government last year approved four new projects, Jiangsu Huadian Ganyu LNG, Huizhou LNG, Putian LNG and Yingkou LNG. Together the four facilities will have a combined import capacity of just over 20mn mt/yr. Construction of the 3mn mt/yr Jiangsu Huadian Ganyu terminal started in February. The prime movers behind the projects are all power companies rather than Chinese state oil and gas companies.

Hong Kong’s entry to the LNG market is also imminent with the final commissioning of the Hong Kong offshore LNG terminal. State oil company PetroChina supplied the commissioning cargo in May to the MOL-owned FSRU Challenger, which will be renamed Bauhinia Spirit.

The project has been developed by HK Electric and Castle Peak Power, which is majority owned by CLP Power Hong Kong. The Bauhinia Spirit is the world’s largest FSRU and will supply regasified LNG to the Black Point and Lamma power stations.

The construction of new LNG terminals is being accompanied by other midstream and transmission infrastructure, which will facilitate the use of imported gas. A recent report by GlobalData said that of 89 midstream projects likely to start operations in China by 2027, 41 would be regasification terminals, with the largest being Tangshan II Phase I, Zhoushan III and Qingdao Phase III.

According to the International Energy Agency (IEA), Asia will add over 100bn m3 of new LNG import capacity by 2025, more than half of which will be in China. The agency also noted that despite the volatility in LNG markets, China approved twice as much gas-fired generation capacity in 2022 than in the previous year.

Most of this new capacity is planned for the country’s densely-populated southeastern coastal regions closer to LNG import facilities than China’s main import pipelines, which bring gas in from Russia in the far north and Central Asia in the far west.

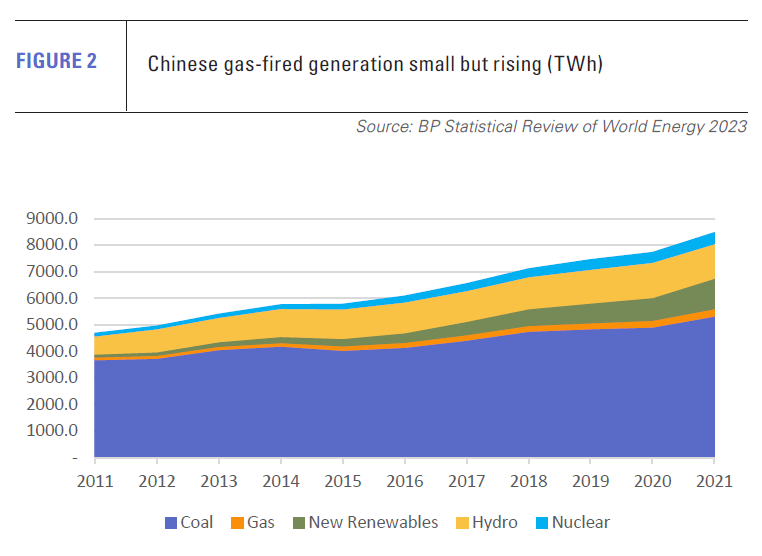

The direction of policy with regard to gas-fired generation is interesting as the fuel has played a very limited role in the Chinese power sector to date. Weak LNG demand at present reflects low industrial demand. China generated only 273 TWh of electricity from gas in 2021, compared with 5,339 TWh from coal and 1,153 TWh from renewables, not including large hydro (see figure 2).

Dhamra LNG adds to India’s import capacity

India, which like China last year curtailed its LNG imports in the face of fierce competition for available volumes, is also gearing up for more imports in future.

India’s LNG imports totalled about 22mn mt last year, a large majority supplied under long-term contract, while regasification capacity stood at 32.5mn mt/yr. This is expected to rise to 55mn mt/yr by 2025, and potentially move as high as 70-80mn mt/yr by 2030, according to some estimates, accompanied by significant investment in domestic transmission and distribution capacity.

This may seem an overly optimistic outlook, considering the setbacks to a number of Indian LNG projects last year as Europe attracted the bulk of available FSRUs. In addition, major transmission and distribution projects in the country have more than a tendency to fall behind project timetables.

This may seem an overly optimistic outlook, considering the setbacks to a number of Indian LNG projects last year as Europe attracted the bulk of available FSRUs. In addition, major transmission and distribution projects in the country have more than a tendency to fall behind project timetables.

However, India’s LNG plans are likely to move back on track as LNG markets normalise and developers start to secure more offtake agreements for the large amount of new liquefaction capacity expected to come onstream from 2026, with Qatar and the US playing lead roles as suppliers.

With existing spare capacity and the start-up of the Dhamra LNG terminal in eastern India in April, Indian LNG imports have ample capacity to rise if market conditions provide affordable volumes of LNG. Dhamra LNG, a joint venture between France’s TotalEnergies and India’s Adani Group, has capacity of 5mn mt/yr and is expected to import 2mn mt in its first year of operation.

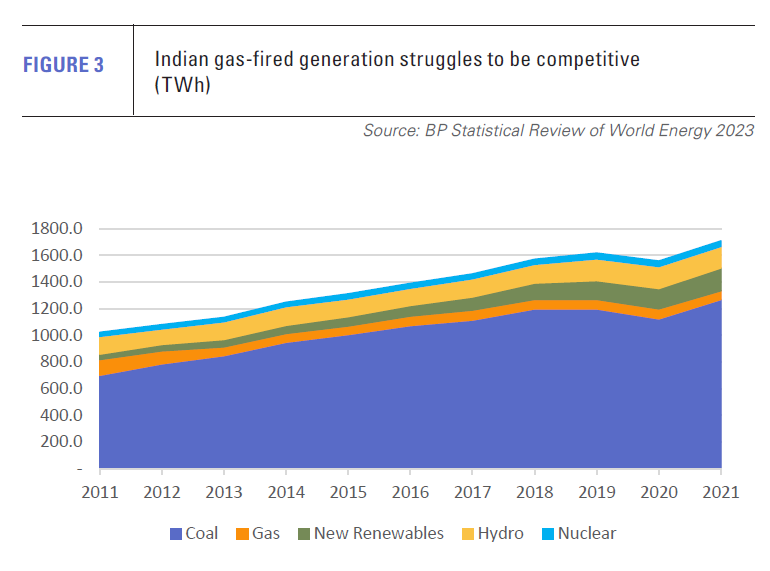

Moreover, the government remains committed to its goal of increasing gas consumption as a share of the energy mix to address its heavy dependence on coal (see figure 3). Prime Minister Narendra Modi recently said the country’s gas consumption would rise five-fold in coming years, as the fuel’s share of the energy mix grows from 6% to 15% by 2030. A large part of this will have to come from LNG, given the lack of other import options and limited apparent opportunities to boost domestic gas production.