Asian LNG: a post-pandemic rebound? [LNG Condensed]

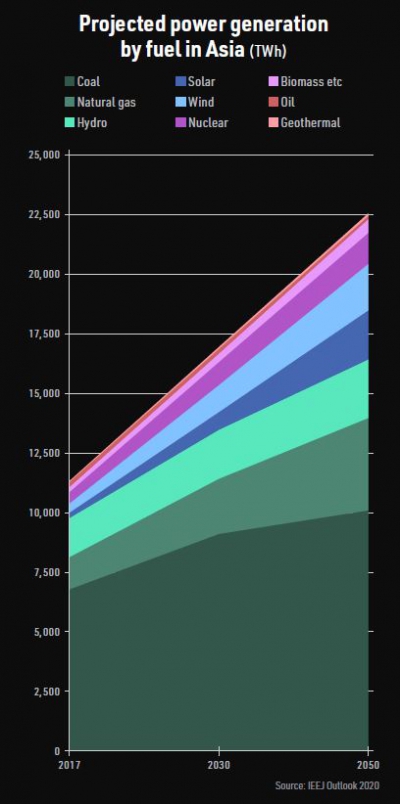

Most gas is used in power generation, and in industrial, residential and commercial applications. In 2017, some 43% of Asian gas was used for electricity production, according to the Institute of Energy Economics Japan (IEEJ). The IEEJ added in its Outlook 2020 that direct gas use in buildings and the industrial sector accounted for much of the rest.

The IEEJ study – published before the onset of the pandemic – forecast that the proportion of gas used for electricity generation and of power generated by gas in Asia would continue to rise. The power sector was expected to account for half the growth in Asian gas demand, which was forecast to increase from 708bn m3 in 2017 to 1,753bn m3 in 2050.

By contrast, oil is increasingly a transport fuel. According to the IEEJ, the share of Asian oil consumed in transport rose from a third in 1980 to over half in 2017, with non-energy use accounting for much of the remaining demand. The IEEJ projected that transport’s share would remain at much the same level to 2050, with the sector forecast to take 11.4mn b/d of the 18.8mn b/d increase projected in Asian oil consumption from 29.1mn b/d in 2017 to 47.9mn b/d in 2050.

Short-term pain

While the long-term impact of Covid-19 on oil and gas will not be clear for some time, in the short term it is certain oil consumption has taken a severe hit from reduced transport demand. Some of this traffic will not return, at least in the near term, as a result of factors including depressed economic activity and increased telecommuting.

The reshoring from China of some manufacturing production (for instance of personal protection equipment) is also under active consideration in many countries in Asia and beyond.

How long security of national supply will be given priority over the lower costs associated with large-scale international production and trade remains to be seen. But, in the interim, shorter and less complex supply chains are expected to have a significant impact on the level and location of land, air and maritime transport in Asia.

However, the pandemic’s impact on Asian gas demand will be less dramatic than for oil in the near term since its use in transport is limited.

Nor will the impact all be negative. Gas could benefit from the potential restructuring of regional economic activity. For instance, more gas-fired generation may be needed to power reshored manufacturing facilities or higher and more variable residential electricity use as a result of remote working.

However, any such benefits are likely to be outweighed in the immediate future in many countries by reduced power generation and direct gas use as a result of sharply curtailed economic activity.

Economic impact

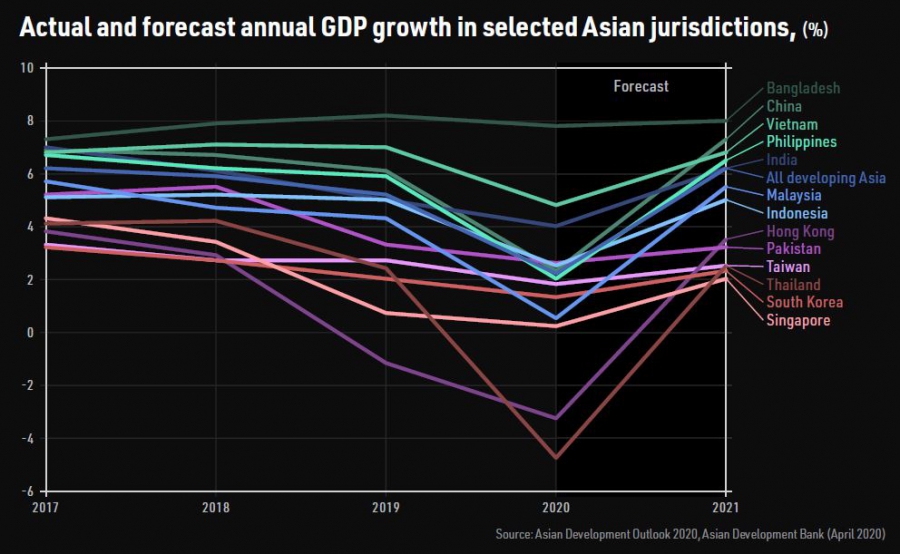

The extent of the economic downturn is indicated by recent GDP projections by the Asian Development Bank (ADB). Its Asian Development Outlook, published in April, forecast that GDP growth in almost all Asian countries will be significantly lower in 2020 than 2019. Activity is expected to rebound strongly throughout the region in 2021, although the ADB warned that this assumes “the outbreak ends and activity normalises.”

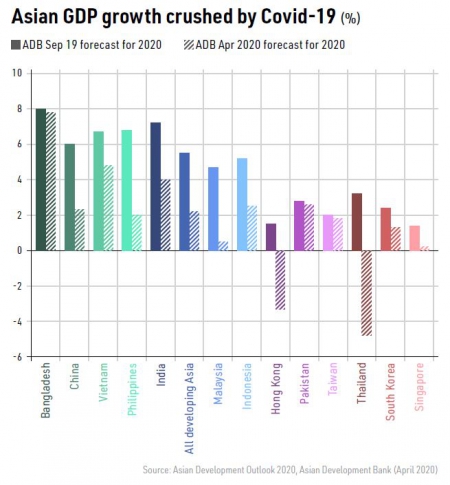

The ADB projects that, with a few exceptions, notably Thailand, GDP will still grow in 2020. However, the 2020 growth rates projected in the current outlook contrast starkly with those in the ADB’s previous study, issued in September 2019. There the ADB projected that China would grow by 6% year on year in 2020 – by April the forecast had fallen to 2.3%.

To a great extent the ADB’s projections reflect the timing of the virus’ spread to different parts of Asia. For instance, the earlier-affected East Asian states are forecast to suffer lower growth in 2020 than South Asian countries, where the pandemic took hold more recently. That said, some of the latter countries could see growth significantly downgraded as the virus runs its course.

Countries throughout Asia could face further economic pain if more waves of the virus occur. ADB Chief Economist Yasuyuki Sawada observed: “the evolution of the global pandemic -- and thus the outlook for the global and regional economy -- is highly uncertain. Growth could turn out lower, and the recovery slower, than we are currently forecasting.”

Given the uncertainties and wide variations between individual countries, the impact of the pandemic on gas and LNG demand at regional level is difficult to assess. Even at national level the pandemic is still at too early a stage to confidently assess its impact beyond the near term.

China

China was the starting point for the pandemic and first country to initiate and end a lockdown. The lockdown that began in Wuhan January 24 ended April 8.

The end of the lockdown certainly stimulated activity, with the economy beginning to recover from the 6.8% on-year contraction in GDP it suffered first-quarter 2020. Industrial output grew by 3.9% year on year in April, a higher rate than analysts had generally expected.

However, it is uncertain how sustainable the uptick in Chinese manufacturing will be. The severe global impact of the pandemic means that overseas orders are stalling, the trade dispute with the US is boiling up again, and consumer spending and fixed-asset investment at home remain weak.

Beijing had targeted GDP growth of 6% in 2020, but on May 22 dropped the target. Most forecasters expect the outcome to be well below that. The ADB expects growth of 2.3%, the International Monetary Fund 1.2%, while ING Groep NV anticipates a 1.5% contraction. While some analysts believe growth will bounce back to past levels in 2021 -- with the IMF projecting growth of 9.2% -- others are sceptical this will happen.

Chinese electricity demand fell in tandem with GDP. National Energy Administration data showed a drop of 6.5% year on year in first-quarter 2020 to 1,570 TWh.

Recovery started in the industrial and residential sectors in March, although this was more than offset by plummeting service sector use. The recovery accelerated in April, with the State Grid Energy Research Institute saying power use rose by 2% year on year. For 2020 as a whole, the China Electricity Council is projecting demand will rise by 2-3%.

However, many commentators are less bullish. Fitch Ratings noted in mid-May that “in light of the elasticity between China’s power consumption and GDP growth, we expect demand to grow at below 1% in financial year 2020 and not revert to pre-2020 levels until late 2021.”

Fitch added: “our assumptions are subject to considerable uncertainties, including the possibility of more disruptive Covid-19 outbreaks and prolonged weakening of global demand.” Importantly, it also noted that individual generators would be affected by the “pace of recovery in local demand, which was quite varied in March 2020.”

In this respect it observed that the first quarter had seen “a sharper fall in demand in eastern China” – one of the main regions for Chinese LNG-fired generation.

Chinese gas prospects

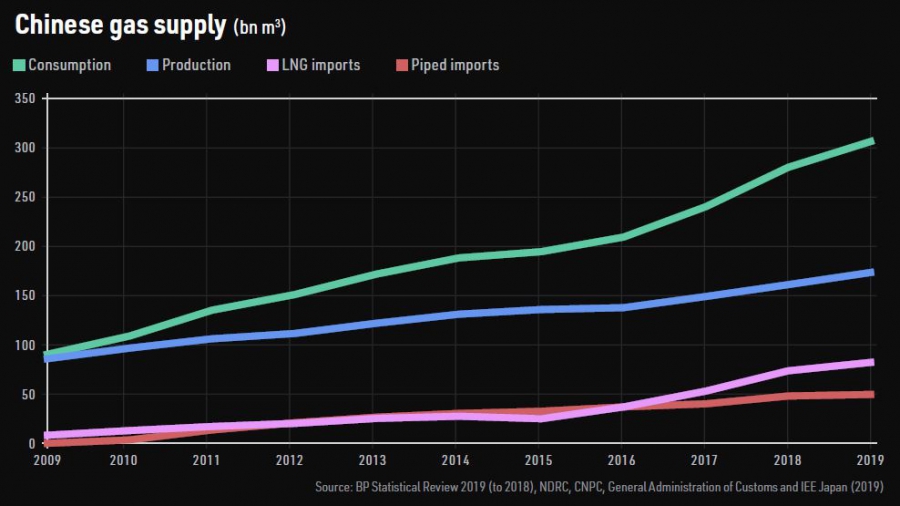

It appears likely that Chinese gas demand will still be higher in 2020 than the 306.7bn m3 consumed in 2019, but with little consensus on how much higher. Moreover, the government’s emphasis on increasing domestic gas production by at least 5% from the 173.6bn m3 produced in 2019 could hit LNG and piped gas imports, which, in 2019, stood at 82bn m3 and 49.4bn m3, respectively.

At the upper end of the gas demand range, the China National Petroleum Corporation forecast in mid-May that consumption could reach 338bn m3 in 2020. By contrast, IHS Markit forecasts demand of 312bn m3 – less than 2% more than in 2019 -- while Wood Mackenzie forecasts growth of 4-6% from 2019.

Gas production totalled 64.4bn m3 from January to April, according to the National Bureau of Statistics, up 10% year on year. Imports rose 1.5% to 44bn m3 over the same period, although the key driver appears to have been the attraction of extremely low LNG prices for importers with spare storage capacity, rather than an uptick in demand.

With domestic production ahead of target and much of the country’s gas storage capacity already full after an unusually mild winter, muted gas demand could translate into a squeeze on imports for the rest of the year.

LNG is generally expected to fare better than piped imports given its geographical spread and price flexibility, but forecasts for 2020 still range widely.

Wood Mackenzie has projected LNG demand growth of 6.6% to 65mn mt (88bn m3), while Rystad Energy has forecast 1.8% growth to 61.3mn mt. ICIS projects demand will fall 5.2% to 58.1mn mt, although adds that demand could rebound by 10% in 2021.

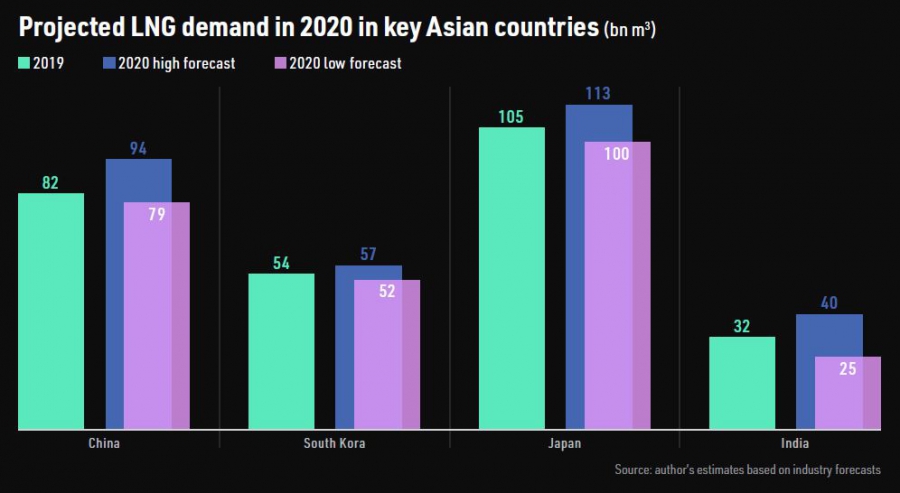

With over four months of the year already gone, there is thus still considerable uncertainty about the outcome for Chinese LNG demand in 2020, ranging from under 80bn m3 to the 94bn m3 projected by CNPC at the start of the year.

2021 offers even greater uncertainty, with the future behaviour of Chinese consumers still far from clear and the continuing need to factor in downside risks such as a second surge of infections, no resolution to poor relations with the US, or a swingeing loss of export markets.

South Korea

The ADB forecasts that South Korean GDP will grow by just 1.3% in 2020, unsurprisingly lower than the 2% growth recorded in 2019, given the stringent measures the country is undertaking to control Covid-19, combined with the country’s long-running economic travails.

GDP did grow by 1.3% in first-quarter 2020, but April and May have seen precipitous falls in factory output and export orders, suggesting 1.3% for the year may be on the high side.

Muted economic activity was reflected in gas demand. First-quarter sales by state gas company Kogas fell 2.1% year on year to 10.9mn mt. Sales to generators rose 4.4% to 4.3mn mt, but this was more than offset by a 5.9% fall in city gas sales to 6.6mn mt.

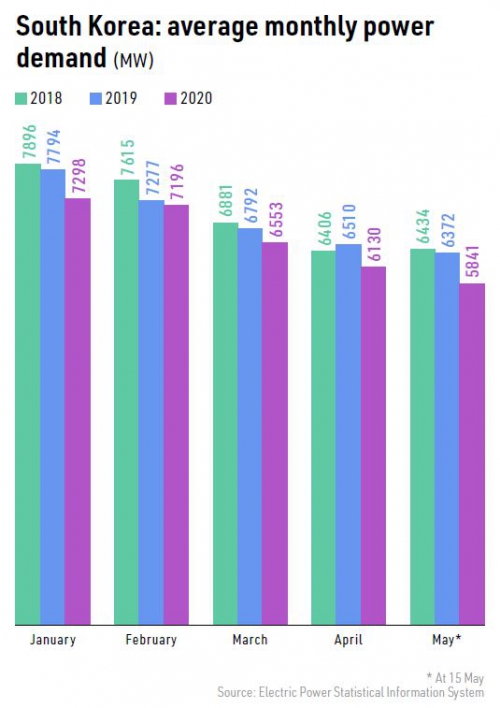

Gas-fired generation increased because coal-fired output was cut for environmental reasons, rather than because of growing electricity demand. Electric Power Statistical Information System data shows average and maximum power supply falling year on year in each month of 2020 to date.

Despite the gloomy background, Korean LNG imports increased sharply in the first quarter, jumping year on year by 20% to 2.09mn mt.

However, imports during first-quarter 2019 were low and the first-quarter 2020 figure was much the same as first-quarter 2018. Moreover, much of the LNG was bought because of its very low price and went into storage, with most analysts anticipating little growth in LNG imports in 2020 as a whole, if at all.

ICIS has projected that 2020 will see LNG demand fall by 4.7% year on year to 38.5mn mt, with only a modest recovery to 39.3mn mt in 2021. Rystad Energy has also forecast a drop, albeit by only 0.5% to 40.5mn mt. Wood Mackenzie is more bullish, projecting 2020 demand growth of 7.7% on year to 42mn mt as gas displaces coal use in the power sector.

In the longer term, it seems likely South Korean gas-fired generation will grow in line with the government’s election pledge to reduce nuclear and coal-fired generation in favour of LNG and renewables. But, for 2020, LNG demand appears unlikely to range much beyond 52-57 bn m3.

Japan

The pandemic took hold relatively slowly in Japan, with a partial state of emergency only declared April 7 and extended countrywide on April 16. However, the struggling economy had already posted a 4.5% on-year contraction in the first quarter, with a much steeper fall in GDP anticipated in the second and little recovery expected until at least the fourth quarter of this year.

First-quarter power demand fell less steeply than GDP, with cooler than usual weather supporting demand in the residential sector. And, on the supply side, LNG-fired plants benefited from reduced nuclear availability.

Even so, first-quarter 2020 LNG imports fell by 3.7% on year to 21.3mn mt, with the prospects for 2020 as a whole uncertain. ICIS has projected imports will fall 1.1% year on year from 77.1mn mt to 76.2mn mt, and drift down further to 73.2mn mt in 2021. Rystad Energy tells a similar story for 2020 at 76.4mn mt. But Wood Mackenzie is more bullish, projecting growth of 5.1% to 81mn mt for 2020.

Longer term, Japanese LNG demand could benefit if a significant number of manufacturing facilities lost to China in recent decades are reshored. But, in the near term, there appears little chance of a significant bounce back. While there can be confidence that demand is unlikely to exceed the 112.5bn m3 recorded in 2018, there is no certainty that 100bn m3 will be the floor.

India

The ADB projected in April that Indian GDP would grow by 4% in 2020, but the figure is likely to be revised downwards following the stringent lockdown imposed March 24.

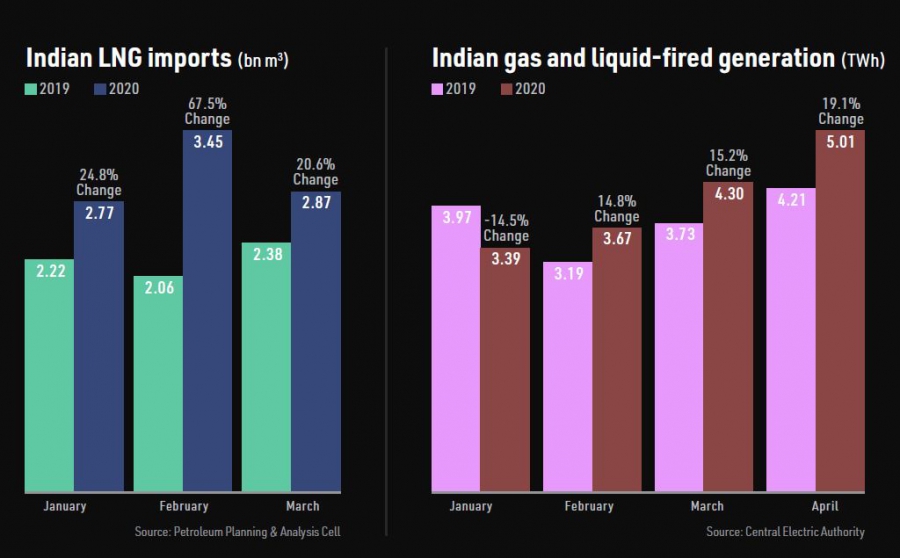

The impact is evident from Indian power data. According to the Central Electricity Authority, generation grew 2.7% year on year in January and 10.9% in February. However, March saw a 7.2% contraction as lockdown began, and provisional data indicates that in April generation slumped by about 75% year on year. With nuclear and renewable output both up on 2019 levels, the fall was borne by thermal generation.

However, in this instance thermal meant coal-fired generation. Indian National Power Portal data shows that output from gas and liquid-fired generators increased substantially from February to April, with output reaching 13 TWh, compared with 11 TWh in the same months of 2019.

This coincided with an influx of low-cost LNG, with 9.1bn m3 being imported in first-quarter 2020, according to Petroleum Planning and Analysis Cell data. This was almost 40% higher than in first-quarter 2019, and well above the 7.2bn m3 contributed by the declining domestic gas sector.

How the Indian LNG market evolves during the rest of the year will depend on how quickly, and at what level of demand, industrials, city gas suppliers and generators resume operations following the lockdown. There are also supply-side issues, including the availability of pipelines to distribute some of the LNG and the approaching monsoon season. These factors could skew LNG imports downwards in 2020, with the potential range anywhere between 25bn m3 and 40 bn m3.

Looking ahead

How the pandemic eventually plays out will not become apparent for many months, but, for 2020 at least, it will constrain gas and LNG demand in the main Asian markets.

The main downside risk at national level is a surge of new infections resulting in renewed lockdown, while the main upside is in countries such as South Korea or India where political or cost factors favour LNG use over coal or other power station fuels. For 2021 and beyond, cost and environmental policy will be key determinants of the evolving location and overall level of Asian LNG use.