Argentine LNG market gets boost [NGW Magazine]

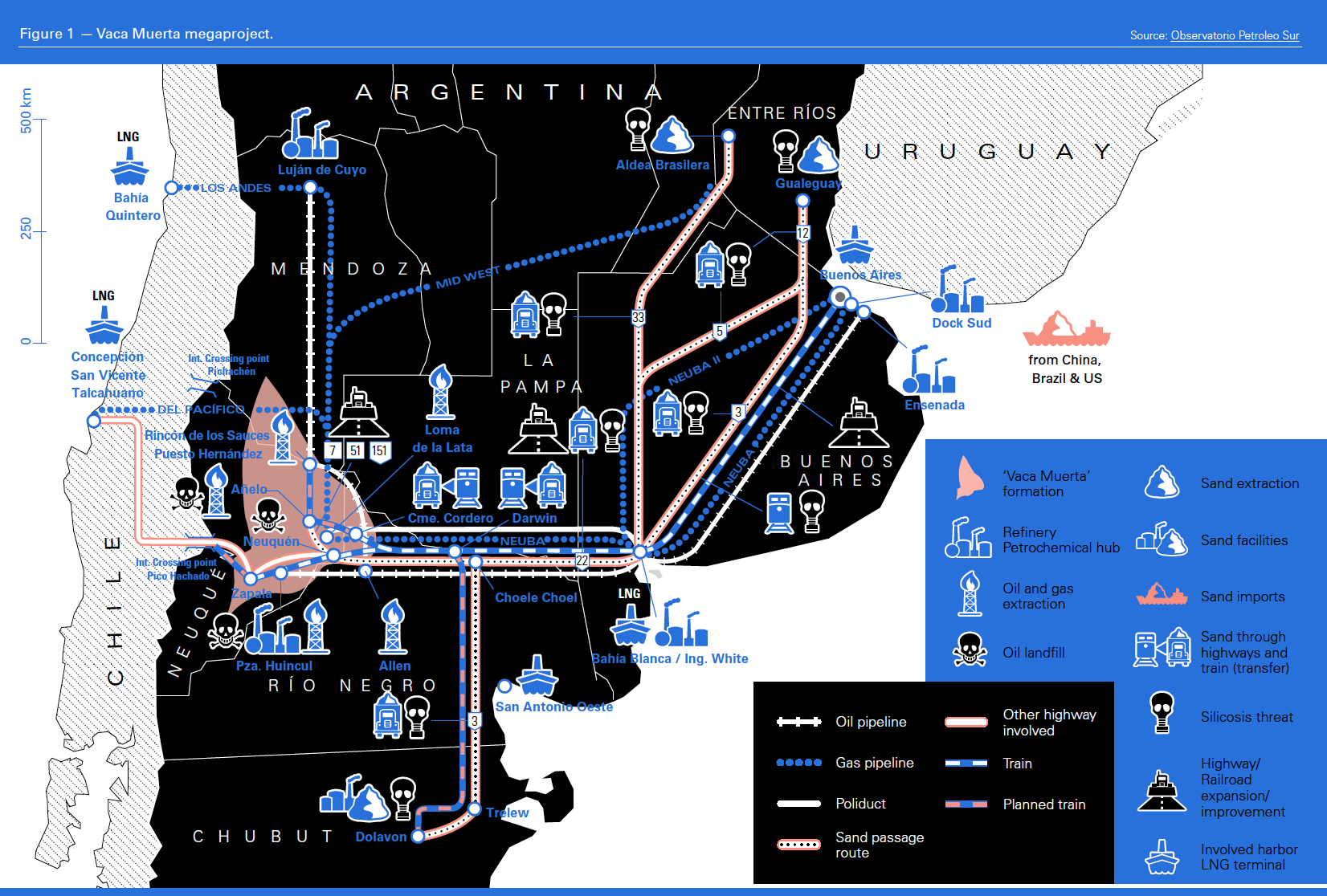

A new potential plan to build a liquefaction facility on Argentina’s Atlantic Coast comes at a time when concerns escalate about potential over-supply issues caused by new production from one of the world’s largest shale gas formations.

Argentine gas transporter, Transportadora de Gas del Sur (TGS), and US-based independent Excelerate Energy, signed in September a memorandum of understanding to evaluate construction of the south American country's first liquefaction plant.

The two firms are considering building the facility in the port city of Bahia Blanca, in the south of Buenos Aires province. They have not yet specified whether the facility will be for floating or onshore liquefaction but plan to complete a study of the potential facility before the end of the year.

The energy ministry had said that the plant would have initial capacity to export 40mn m³/day in 2023, and that would later increase to 120mn m³/d, giving Argentina around a 5% share of the global LNG market by 2026.

Market sources have also tentatively suggested that an export terminal could be built in the far south, in the Tierra del Fuego region, as well as on the Atlantic Coast. Alternatively, Argentina could build one on the Chilean coast, in order to access markets in Asia.

However experts note that Argentina would need more gas storage capacity to equalise winter and summer demand before it can make any LNG export plans.

Output up

Last year, Argentina produced 122mn m³/d and that has now gone up to 134mn m³/d of gas.

However the government expects the development of Vaca Muerta to double production to 238mn m³/d in 2023, before rising to 400mn m³/d in 2030. Meanwhile domestic gas demand is not expected to surpass 200mn m³/d.

Gas oversupply could be felt from as early as next year, according to some. Argentina could have between 5 and 10mn m³/d of oversupply by next summer, Wood Mackenzie’s Latin American gas analyst Mauro Chavez Rodriguez told NGW.

That is due to increasing domestic gas production but also lowering gas demand in the country, he said.

The demand for gas in Argentina has been declining owing to higher tariffs implemented by the president, Mauricio Macri and “sluggish economic performance more generally,” the Oxford Institute of Energy Studies said in a report last year.

Other than Chile, Argentina could in theory export its excess gas to neighbouring Brazil or Uruguay, however there are obstacles, noted Chavez. Uruguay is a very small market – of around 1mn m³/d – while Brazil requires extra pipeline infrastructure to be built, he said.

With production from the Vaca Muerta shale formation set to considerably boost Argentina’s supplies in the next few years, the pro-business government under Macri is keen to find a home for the gas it produces to prevent it from flooding the domestic market.

Argentina has two operating LNG terminals: the GNL Escobar on the Parana River, in Buenos Aires province; and the Bahia Blanca terminal, about 400 miles south of the capital. Both have regasification capacity of 14mn m³/d.

However the country is already cutting back on LNG imports, as its domestic production rises. In October, the energy ministry cancelled a contract with Texas-based Excelerate for a floating storage and regasification unit it has in the country, as rising shale gas production reduces the need for imports.

Vaca Muerta, which is around the size of Belgium and contains around 308 trillion ft³ of shale gas, according to the US Energy Information Administration, is expected to significantly boost Argentina’s gas output when production is fully ramped up.

New markets

In October Argentina is to resume unrestricted exports of natural gas to its neighbour Chile after more than a decade of reduced flow, as the country looks for new markets for its gas to help prevent oversupply issues.

The gas is expected to come from both Vaca Muerta in central Argentina’s Neuquen basin and from the Austral basin in the far south of the country.

The gas would replace imports from other countries or be used to heat homes in remote areas where wood-burning is still the norm, but is a source of pollution, Chile’s energy minister Susana Jimenez has said.

There are already several pipelines in place between the two countries, which were used previously to export up to 20mn m³/d.

Chile produces marginal volumes of oil and gas of its own from the southern Magallanes Basin but used to receive a significant volume of its gas from its neighbour but a diplomatic crisis in the mid-2000s led to Argentina cutting off exports when its supplies were low.

The two countries subsequently signed deals allowing for exports in emergency situations, but with the caveat that the same amount had to be re-imported to Argentina within a period of twelve months.

On the back of lower supplies from Argentina, Chile was forced to turn to Bolivia and the global LNG market for its gas needs.

However experts say that the start of gas exports to Chile will not be enough to prevent oversupply in Argentina.