Argentina to join LNG production club [LNG Condensed]

A lack of pipeline capacity within Argentina had slowed the development of Argentina’s giant shale play Vaca Muerta, which lies in the province of Neuquen in the southwest, but 2018 saw a big jump in output. Gas production increased by 193% over the year, alongside a 52% rise in oil output, as investment by Shell, Chevron and ExxonMobil kicked in. These rises were partly balanced out by a fall in conventional oil and gas production, including a 19% decrease in conventional gas output, but production in Neuquen as a whole reached 66.6mn m³/day, the highest figure since 2009.

Vaca Muerta holds an estimated 9.3 trillion m³ of shale gas, out of total national reserves of 24.3 trillion m³. This ranks it second worldwide after Eagle Ford, although some sources have suggested that it could be even bigger than the US field. A total of 34 licenses have been awarded on the Argentine find, of which just seven are thus far in development.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

The field will undoubtedly revolutionise the country’s gas industry, but it is important not to overestimate the contribution to national production that has already been achieved. Total gas production reached 132mn m³/day in October, of which shale gas accounted for 25mn m³/day, most of it on Vaca Muerta.

Argentina’s shale oil and gas industry is being driven by investment by the majors, unlike in the US, where independents took the lead. In December, Shell announced plans to develop three blocks on Vaca Muerta that will produce 70,000 boe/day by 2025. It will focus on oil production in the first instance, before using oil revenue to finance gas development.

Vaca Muerta’s potential as a source of LNG production was highlighted last year, when Qatar Petroleum (QP) bought 30% stakes in seven ExxonMobil-operated shale blocks in what was “its first significant international investment in unconventional oil and gas resources”, according to QP CEO Saad Al-Kaabi.

Impact on the Argentine gas sector

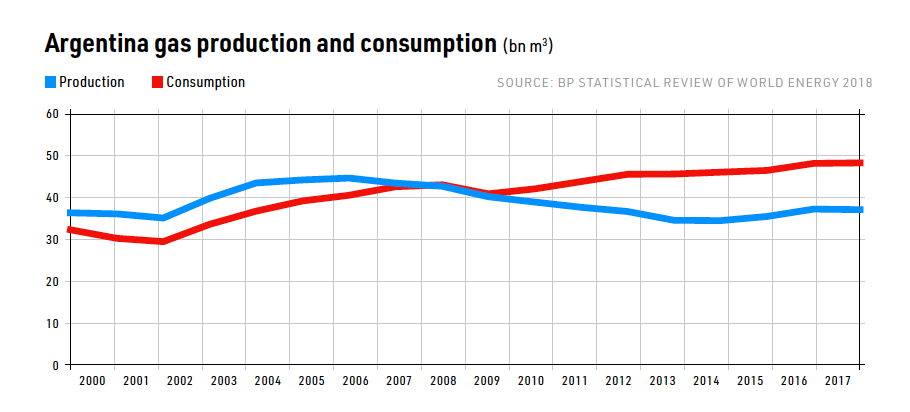

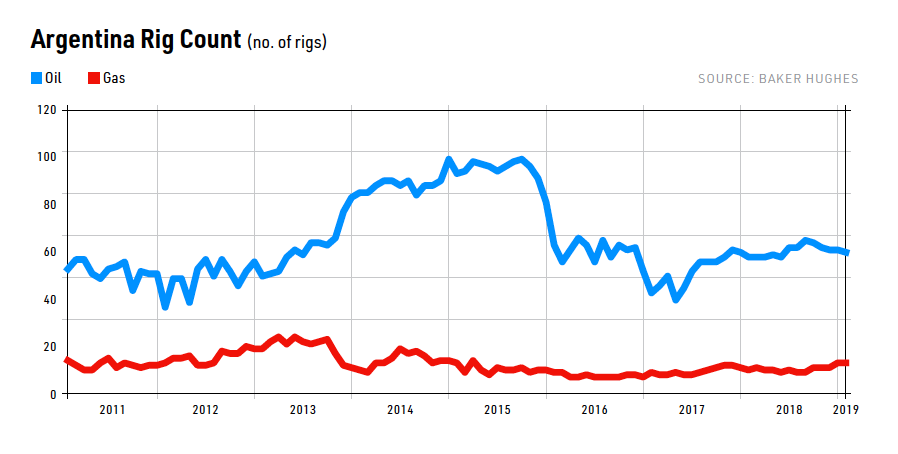

Argentine gas production has fluctuated widely over several decades, but the fall that began in 2006 has finally been arrested and output looks set to rise year-on-year for a long time to come.

Even as late as early 2018, the energy ministry forecast that domestic gas production would reach 174-200mn m³/day by 2030. It now expects gas production to reach 260mn m³/day by 2023, with exports of 80mn m³/day. Some officials have also suggested that 400mn m³/day would be possible by the same date, which would almost certainly enable large-scale LNG and piped gas exports, given that current average domestic demand stands at about 140mn m³/d.

Higher production is being driven by higher gas prices. The government of President Mauricio Macri has lifted the gas price caps introduced by his two predecessors, the husband and wife team of Néstor Carlos Kirchner and Cristina Elisabet Fernández de Kirchner, who governed between 2003 and 2015.

Heavily regulated prices deterred upstream investment and stimulated demand; with the result that production fell to an average of 114mn m³/day in 2014, from 143mn m³/day a decade earlier, prompting the country to start importing LNG. The government agreed to increase the wellhead price of gas from $3.42/mn Btu in October 2016 to $6.80/mn Btu three years later and price regulation should be completely lifted by 2022.

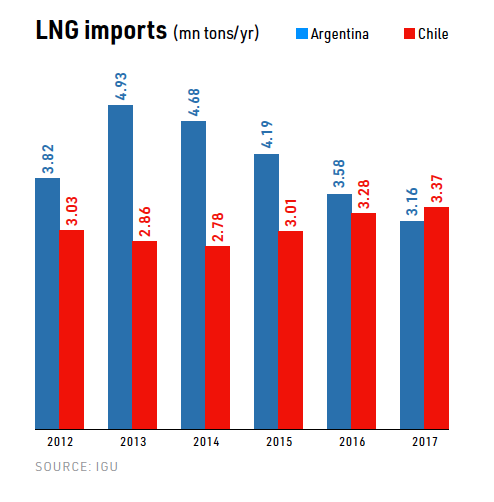

Rising gas production is also affecting LNG imports, which the government expects to end completely by 2023. In October, US company Excelerate withdrew its floating storage and regasification unit (FSRU) from the port of Bahía Blanca and the long term of fate of the country’s two onshore LNG terminals is under threat.

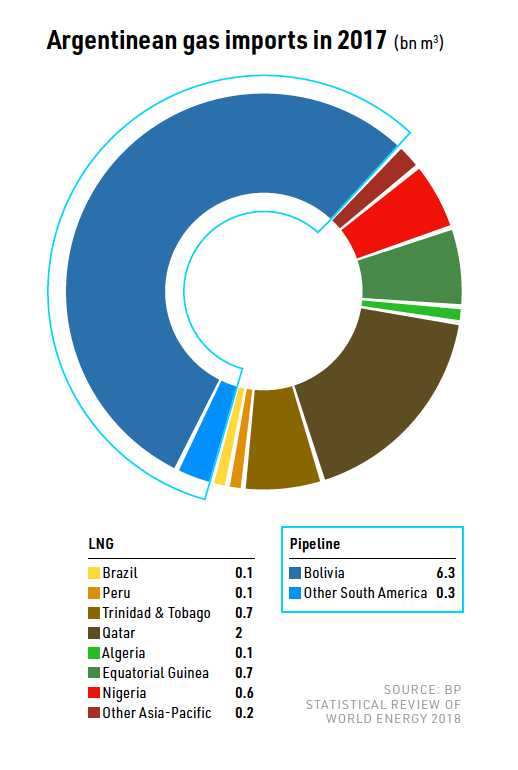

Argentina has LNG import capacity of 7.6mn mt/year: with 3.8 mn mt/year at both Bahia Blanca and Escobar, which were only completed in 2008 and 2011 respectively. Argentina also imports an average of 18.8mn m³/day from Bolivia. This trade is subject to a long-term deal and is likely to be sustained until 2026.

LNG exports

On the other side of the balance sheet, Argentina is about to take its first steps into the world of LNG production. Under a deal signed with mainly state-owned Yacimientos Petroliferos Fiscales (YPF) in November, Belgian firm Exmar is to deploy its Tango FLNG vessel at Bahía Blanca to liquefy gas from Vaca Muerta for ten years. Tango arrived in early February and will begin LNG production in the second quarter of this year, making it the first operational FLNG vessel anywhere in the Americas and one of the few anywhere in the world.

It has storage capacity of 16,100 m³ and production capacity of just 500,000 mt/year, but at least it gives Argentina a start in LNG production. YPF President Miguel Gutierrez said: “Thanks to the commercial relationship with Exmar we are now able to add value to the resources extracted from Vaca Muerta, and take full advantage of the seasonal opportunity with Asian markets and our unique location to serve demand centres.”

In addition, in September, Transportadora de Gas del Sur signed a memorandum of understanding with Excelerate Energy of the US to study the viability of developing an onshore LNG plant at Bahía Blanca. The government hopes that the development of an LNG plant will be sanctioned after October’s elections, but has indicated that it will hold a tender for a contract to build and operate the project, if developers do not come forward before then. Officials have suggested that six trains with production capacity of 40mn m³/day are likely. Reserves on Vaca Muerta will be ringfenced for the project.

Economic fragility

Macri is particularly keen to cultivate higher oil and gas production because of the dangerously fragile state of the economy. Although inflation has been brought under control, interest rates rocketed and the peso lost almost half of its value against the US dollar last year. The government turned to the IMF for support, but has been forced to implement reforms – many of them unpopular – in return for a massive $56.3bn in loans.

Subsidies, including on power, have been cut, pushing up retail prices, which in turn should depress demand for gas. Even ministers recognise that the subsidies have encouraged wasteful consumption. However, the economic crisis impairs the government’s ability to borrow to invest in energy sector infrastructure, particularly as it has defaulted on its debts on eight occasions since independence, including twice since the turn of the millennium.

Macri was elected on a platform of economic liberalisation, but popular discontent at price rises could slow the pace of change, particularly as he faces re-election in October. The government is to try to cushion the blow of lifting subsidies by cutting the level of value-added tax on gas from 21% to 10.5% for residential customers and 15% for small businesses.

Impact on Chile

The development of Vaca Muerta has already begun to affect LNG imports into Chile as well as Argentina. Gas trade between the two countries has an unhappy history. Seven pipelines were built between the two countries between 1997 and 2004, but Argentina unilaterally halted all exports to Chile in 2007 because of its own energy crisis. It also failed to fulfil supply contracts with Brazil and Uruguay.

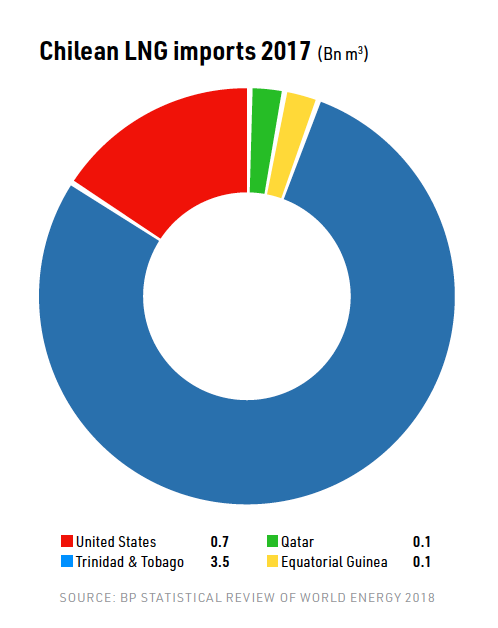

The fact that exports were halted so soon after the pipelines were built suggests severe mismanagement of the Argentine gas sector at that time. The move left 2,900 MW of new Chilean gas-fired generating capacity stranded, prompting Santiago to sanction the construction of the Quintero and Mejillones LNG import terminals to supply its new gas-fired power plants. Another LNG import terminal was planned for Concepción, but the project has been repeatedly delayed.

The situation has now come full circle, with Argentina resuming gas exports to Chile, albeit on short-term contracts. There was some reluctance in Santiago over resuming Argentine imports because of residual anger over the events of 2007, but the current Argentine government is very different to that of 2007.

Moreover, gas relations improved in 2016 when gas flowed in the opposite direction across the Chile-Argentine border, as gas originally imported as LNG began to be re-exported to Argentina. Flows are reversing once again.

Argentina’s Compania General de Combustibles has signed a deal to supply Chilean power company Colbún with up to 4.1mn m³/day via the GasAndes pipeline. Local media report a price of $4.10-$4.20/mn Btu, plus transport costs of $1.50-$2.00/mn Btu, with first gas piped in October, although the volumes are not fixed and will fluctuate seasonally.

One month later, gas from Vaca Muerta began flowing through the Gasoducto del Pacífico to LDC Innergy in central Chile. The energy ministry in Santiago says that eight companies have applied for licenses to import gas from Argentina; and Argentine officials have suggested that exports to Chile could reach 30mn m³/day by 2022.

LNG imports are likely to continue, particularly during the southern hemisphere winter, but Chilean demand for cargoes has already weakened. Chilean imports from Argentina increased from 13,000 mt in August to 137,000 mt in November, out of total gas imports of 293,000 mt for November.

This made Argentina Chile’s biggest supplier, displacing Trinidad and Tobago. As secondary suppliers to Chile, Platts reported that the US and Equatorial Guinea were likely to be the biggest losers.

However, the increase in gas availability has offset the rise in Argentinian imports to some extent by stimulating demand. For the year to end-November 2018, Chile imported 3.4mn mt, up 15.3% on the same period in the previous year. Chile switched much of its thermal power generating capacity from gas to coal when Buenos Aires shut off supplies, but has now begun the process of switching some plants back, boosting demand for gas in the process.

Nonetheless, given the existing export infrastructure, Argentinean gas exports are likely to erode Chilean LNG demand over time. Buenos Aires is confident that its export strategy can be sustained. According to Argentine energy minister Javier Iguacel, Vaca Muerta will allow Argentina to satisfy its own demand and sustain exports for a century.

_f193x247_1552386214.jpg) LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets.

LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets.

Covering the length of the LNG value chain and the breadth of this global industry, it will inform, provoke and enrich your decision making. Published monthly, LNG Condensed provides original content on industry developments by the leading editorial team from Natural Gas World.

LNG Condensed is your magazine for the fuel of the future. Sign Up Free below:

Volume 1, Issue 2 - February 2019

> Japan: future uncertainty, but potential upside

> Which ship engine should a new ship owner shoot for?

> Argentina to join LNG production club

> Poland’s 2040 energy plan provides key role for LNG

> LNG Canada — a game changer for Canada’s gas industry

> Conference Report: EGC Vienna

and more!

Sign up now to receive LNG Condensed monthly FREE