Africa on Brink of Upstream Surge [NGW Magazine]

Double-digit increases in annual spending on new oil and gas projects in Africa are expected over the next 12 to 15 years, according to a bullish new report from financial services group PwC.

The ‘Africa Oil & Gas Review’ was released November 6 at the Africa Oil Week conference in Cape Town, in a week that also saw a report on the African energy landscape by another financial services group, Deloitte.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Projections for capex and exploration spend in Africa are looking up, the PwC report says.

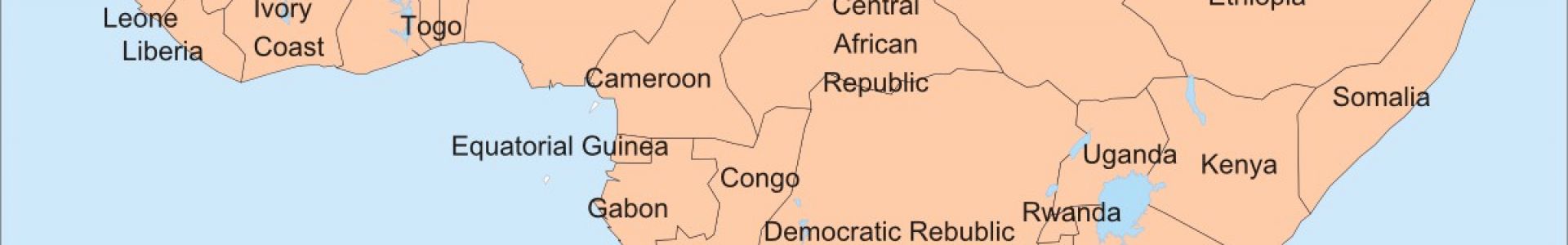

Africa experienced a massive drop in exploration spend of 71% between 2014 and 2017 but a slow and then robust recovery at an average 18% year-on-year over the next 12 years is projected, the PwC report says, from just over $5bn in 2018 to some $50bn in 2030 of which the lion’s share – 22% over the period – will be in east Africa. Globally for exploration, Rystad Energy predicts an average 15% year-on-year increase in spending.

PwC notes that 2017/18 has seen a significant increase in the number and size of final investment decisions, demonstrating a renewed confidence in the sector. Its report suggests that the focus is on “high-quality, bankable projects, rather than the free-for-all approach we saw during the growth-at-all-costs phase preceding the 2014 price collapse.” But it cautions that regulatory certainty is a prerequisite for new capital investment.

Upstream capex in Africa is forecast by PwC to grow on average by 7%/year from about $40bn in 2018 to some $90bn in 2030. Of the cumulative $857bn spend over the coming 12 years, the report expects Nigeria to absorb 19%, Angola 14%, Algeria 13%, Libya 11%, Mozambique 8% and Egypt 7% – the last two primarily on gas developments.

On gas, the report states that “the need for a transition to a lower-carbon economy remains a key driver for the decarbonisation of the global economy. Gas continues to play a significant role as a transition fuel in Africa.”

Major gas finds on the continent, including those in Mozambique, Nigeria, Angola, Tanzania, Senegal and Mauritania, could augment the key position of gas as an energy source for Africans, the report says, arguing that whether as a source for power generation, transportation fuel, or for cooking and heating, gas also has the potential to reach rural areas where it can run off-grid or mini-grid solutions. This is despite most of the above countries backing initial LNG developments aimed at export markets outside Africa.

“However, it is critical that the sector retains its capital discipline and adopts digital technologies if the hard- earned wins in cost savings are to be retained. Progress in addressing corruption and improving corporate governance will also need to be maintained. Moreover, in the longer term, the energy transition will continue to impact the sector’s dynamics with implications for oil demand,” it warns.

Meanwhile, the Deloitte report ‘Africa Oil & Gas: State of Play’ agrees that the oil and gas sector in Africa is once again attracting investor interest, as international energy prices recover. Africa’s proven oil and gas reserves account for 7.5% and 7.1% of global reserves respectively, it notes.

However, the continent’s challenging operating environment, a lack of transparency and regulatory/policy certainty in the resources sector, and an ongoing infrastructure deficit, have often been a deterrent to investors. It says: “An additional ongoing constraint is the lack of sustainable economic development gained by harnessing the windfalls of the sector for economic diversification, most recently illustrated by the oil price crash of 2014.”

It suggests that “although Africa’s share of total global LNG production in the future is likely to remain relatively small, new LNG facilities are at various stages of development in at least nine African countries.

“As a region, Africa accounts for about 5.8% of gas production and 3.9% of consumption globally. The continent is also the third fastest-growing regional consumer globally, behind the Middle East and Asia Pacific, with consumption having grown by 4.8%/yr between 2005 and 2015.”

However, the report notes that domestic consumption of gas “is currently constrained by limited domestic production and a lack of necessary infrastructure. Sub-Saharan Africa (SSA) does not have the requisite pipelines to transport gas, nor are power utilities or industry able to effectively utilise gas for power purposes. Another significant barrier is the current lack of sufficient offtake demand (buyers of future production).”

As these barriers diminish in the medium to long term, sub-Saharan Africa’s own gas consumption will grow substantially, the Deloitte report says, while that of Europe will decrease owing to market saturation and the spread of renewables.

As the conference got underway, Wood Mackenzie said that in the past ten years, explorers in sub-Saharan Africa have turned up more giant discoveries than in any other region. These include “multi-trillion cubic feet gas fields [offshore] Mozambique and Tanzania, play-openers in the Atlantic margin of Senegal and Mauritania, deep-water giants still lurking offshore Nigeria and even pre-salt gems offshore Congo and Angola.”

WoodMac’s senior upstream analyst covering the region, Adam Pollard, said: “The finds highlight the prospectivity of deepwater sub-Saharan Africa, 40 years on from the first discovery, South Tano, offshore Ghana.

“The region still attracts explorers large and small; however, as the majority of discoveries are gas, turning them into viable developments has proved much harder. Converting volume into value is undoubtedly sub-Saharan Africa's Achilles heel.”

Radebe Dreams of Rovuma

The conference heard upbeat speeches from South Africa’s energy minister Jeff Radebe and his deputy Thembisile Majola,

Radebe accepted it was his job to ensure an attractive climate for investors, including regulatory certainty, while calling for partnerships between foreign and national oil companies to create jobs in the region.

South Africa entered into a Gas Trade Agreement with Mozambique in 2004, he said, expressing optimism that recent gas discoveries in the Rovuma basin offshore northern Mozambique will benefit the region’s economies and further bolster regional economic integration. He also noted that the Southern African Development Community (SADC) has initiated development of a masterplan to facilitate regional gas trade, and said this “will require support of financial institutions of the region, continent and beyond.”

But Radebe did not mention the fact that development plans have already been agreed by Mozambique with the Rovuma gas developers (Anadarko, Eni and ExxonMobil) that are based on exporting LNG to the global, not regional, market.

He continued: “In South Africa we recently published for comment by the public an updated Integrated Resource Plan (IRP) which envisages a Gas-to-Power Programme incorporating LNG imports as well as imports through pipelines. The period for comments has since closed and we will consider all comments and submit the final document to cabinet in the next few weeks for approval.”

“Over the past three years, we have been putting in place the enabling framework for private sector participation in our energy sector to enable gas industry development and growth. With regard to infrastructure, we are planning for investment in LNG import terminals, storage and regasification facilities, primary high-pressure gas transmission pipelines and secondary distribution pipeline networks,” he added.

Key SA Decisions Pending

Yet while Radebe is slowly moving things forward, decisions about a promised gas masterplan and gas-to-power projects have yet to be expedited.

The international tender in South Africa for investment in new LNG import and gas-fired generation facilities – expected to occur in 2016 and which elicited strong interest – has yet to be formally issued, despite a new government since February 2018 led by Cyril Ramaphosa. And the country’s power mix remains heavily coal-based.

The minister spoke of the potential to commercialise the undeveloped Kudu gas field off Namibia, and said coal-bed methane prospects in South Africa, Zimbabwe and Botswana show the need for closer cooperation.

He also cited how BP’s recent outlook to 2040 indicated that by then “Africa will account for no less than 20% of the world’s population.” What though was “staggering” was its projected 110% increase in global LNG supplies between now and 2040, with East and West Africa among the key drivers. “Out of these numbers alone the prospects for investment are therefore very significant,” said Radebe.

Majola also spoke of “growing optimism about the potential of Africa’s oil and gas development” since oil prices recovered. She said this augurs well for many African economies that had suffered from the 2014 price slump.

‘West Africa has been to a large extent the main anchor for oil and gas in Africa south of the Sahara,” she said. We are optimistic once again about the potential of discoveries made in Senegal. Projections from [state producer] PetroSen are that the exploitation of two fields could earn Senegal up to $30bn.”

Originally published November 12, 2018 in NGW Magazine Volume 3, Issue 21.