A wave of new LNG is about to hit the markets [Gas in Transition]

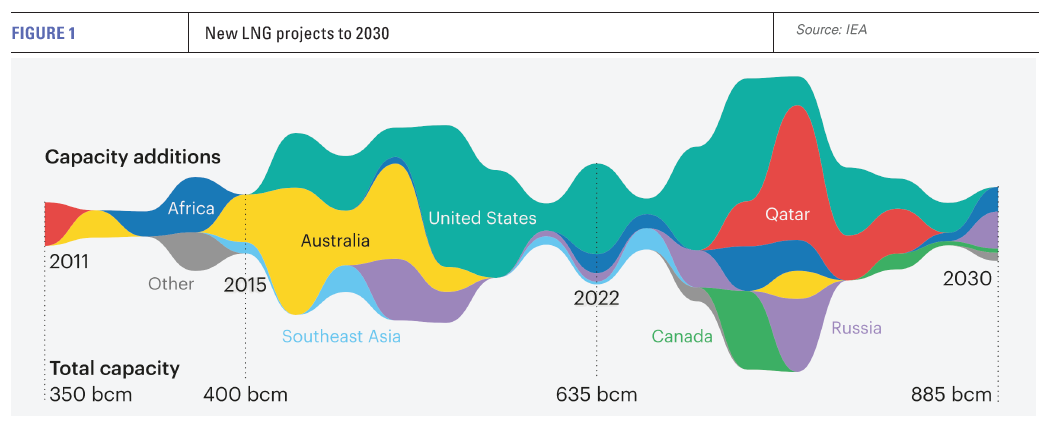

A headline in International Energy Authority (IEA)’s Global Energy Outlook 2023, released at the end of October, was: “A wave of new LNG export projects is set to overturn gas markets.” The IEA says that more than 250bn m3/yr of new liquefaction capacity is set to come online by 2030, about 40% of today’s global LNG supply, with the US and Qatar accounting for 60% of this (see figure 1). The largest increases will come between 2025 and 2027.

Most of this is destined for Asia. China alone has contracted for an additional 85bn m3 of LNG since 2022.

As the IEA points out, “in recent years, gas markets have been dominated by fears about security and price spikes after Russia cut supplies to Europe. Market balances remain precarious in the immediate future but that changes from the middle of the decade.” Once online, this strong increase in LNG production capacity will ease gas supply concerns and prices. It is expected to make natural gas a buyers’ market.

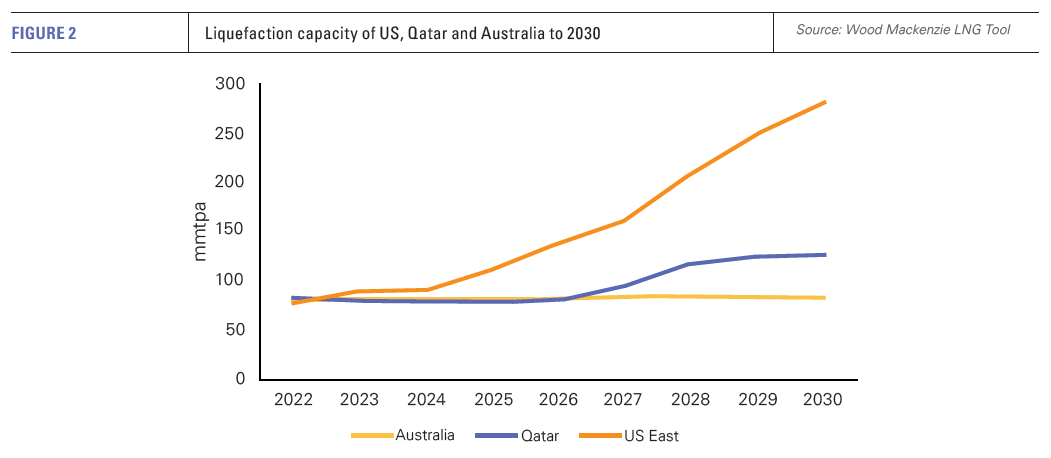

A period of LNG tightness is about to give way to abundant supplies led by the US and Qatar (see figure 2), completely reversing market dynamics. The two countries are best-placed to deliver the next wave of LNG growth through competitive pricing. As Fatih Birol, executive director IEA, said “A wave of new LNG export projects is set to remodel gas markets.”

LNG on a roll

In terms of new LNG liquefaction capacity additions, 2023 was a particularly low year. But this is about to change, starting next year. And between 2025 to 2027 new LNG additions will be on a roll.

This exceptionally strong growth is expected to rebalance the global gas markets. But until then prices are expected to remain high, as will price volatility.

Other projects, especially in the US, are close to reaching final investment decisions (FIDs) and will add to this post-2026.

Three new projects have already been approved, the second phase of Venture Global LNG's Plaquemines plant in Louisiana, with about 10mn mt/yr capacity, Sempra Energy's Port Arthur plant in Texas, with about 13.5mn mt/yr capacity, and NextDecade/TotalEnergies’ Phase 1 of the Rio Grande LNG project in Brownsville Texas, with 17.6mn mt/yr capacity.

There are several more US LNG export projects hoping to secure go-aheads this year and next. Wood Mackenzie expects at least another 60mn mt/yr capacity to take FID by the end of 2024, with the majority on the US Gulf Coast.

However, there is a risk that cost inflation and higher interest rates may yet slow the pace of future LNG FIDs. But that will not affect the massive growth resulting from already sanctioned projects.

Potential risks

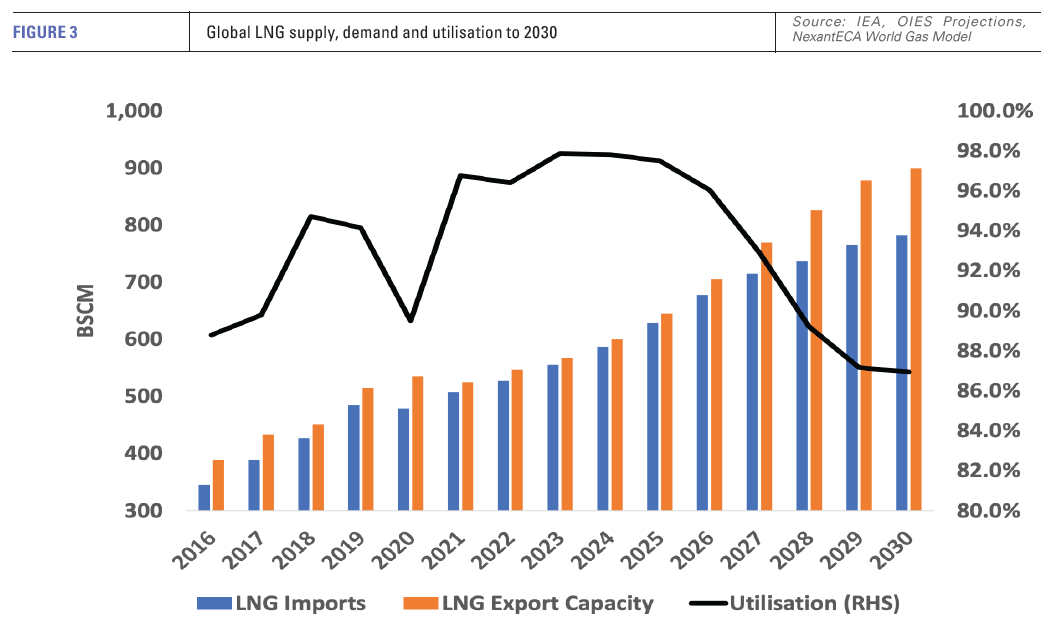

However, as a result of the rapid increase in LNG supply the market risks becoming saturated, with supply exceeding demand towards the end of the decade (see figure 3). That will lead to reduced utilisation of LNG export plants – defined as total LNG imports divided by available LNG export capacity- impacting prices.

The Oxford Institute of Energy Studies (OIES) projects utilisation to start declining by 2026 and dropping to about 87% by 2030 – a level even lower than during COVID-19 in 2020, when TTF prices dropped below $3/mn Btu. Based on this modelling, OIES projects LNG prices to fall somewhere in the range $5-8/mn Btu in both Europe and Asia by 2030.

The Oxford Institute of Energy Studies (OIES) projects utilisation to start declining by 2026 and dropping to about 87% by 2030 – a level even lower than during COVID-19 in 2020, when TTF prices dropped below $3/mn Btu. Based on this modelling, OIES projects LNG prices to fall somewhere in the range $5-8/mn Btu in both Europe and Asia by 2030.

Clearly there could be increasing uncertainty after 2026. Depending on how low prices go, they could put some LNG projects on shaky ground.

However, if a supply glut and low utilisation of LNG export capacity lead to lower prices, these may trigger more gas demand.

In addition, as BP points out in its Energy Outlook 2023, even if “LNG trade increases robustly in the near-term, the range of uncertainty widens post 2030, with continuing demand for LNG in emerging markets as they grow and industrialise, offset by falling import demand in developed markets as they transition to lower carbon energy sources.” Prospects post-2030 will depend on the speed of energy transition.

The rapid increase in renewable energy is expected to make greater inroads into coal and gas utilisation, increasing uncertainty about the future of fossil fuels. BP’s New Momentum scenario in Energy Outlook 2023 shows gas demand increasing by 20% by 2050, but potentially declining by 40% under its Accelerated scenario – an uncertainty range of 60%.

Already in Europe renewables – wind and solar – have become the largest source of power generation, ahead of gas. European gas demand dropped by 14.5% year/year in the first three quarters of 2023. And it may drop further if Europe sticks to its REPowerEU policy to reduce gas consumption by 30% by 2030 and carry on pivoting away from gas all the way to net-zero emissions by 2050.

This gradual move from gas to renewables is also seen to be happening in the Middle East and North Africa.

As OIES points out, “a key uncertainty for gas is in the trilemma between coal versus gas versus renewables.” Investment in coal continues in some Asia-Pacific countries, and, “if gas is seen as unaffordable, it may face an uphill struggle not to be crowded out by coal and renewables.”

But North Asia, Japan, Korea and Taiwan “are phasing coal out and gas will remain an important part of their energy mix, depending on how rapid renewables growth is.”

There is also a risk that a revived nuclear power sector could make inroads into gas utilisation later this decade, at a time of a likely LNG supply glut, increasing pressure on LNG projects. Japan is in the process of increasing nuclear power share to 20%+ by 2030 from less than 7% in 2022. France is also proposing to build six new nuclear reactors by 2035.

Stringer regulations

The EU agreed in mid-November a new law to limit methane emissions that will hit oil and gas imports, including LNG.

The new regulation requires fossil fuel producers to measure, report and verify methane emissions, as well as put in place mitigation measures to avoid such emissions by regularly checking for and fixing methane leaks.

The result of this is that from 2030 onwards producers and traders importing fossil fuels into Europe, including LNG, will have to adhere to the EU's methane emission limits. Financial penalties will apply to importers that buy from suppliers that do not comply with the limits.

The result of this is that from 2030 onwards producers and traders importing fossil fuels into Europe, including LNG, will have to adhere to the EU's methane emission limits. Financial penalties will apply to importers that buy from suppliers that do not comply with the limits.

This will put pressure on suppliers of fossil fuels to the EU to clamp down on methane leaks. These rules will hit all gas suppliers, including in the US and Algeria.

According to the European Council, the part of the regulation affecting imports will be implemented in three phases. “The first phase will focus on data collection and the creation of a methane emitters global monitoring tool and a super emitter rapid reaction mechanism. In the second and third phases, equivalent monitoring, reporting and verification measures should be applied by exporters to the EU by January 1, 2027, and maximum methane intensity values by 2030. The competent authorities of each member state will have the power to impose administrative penalties if these provisions are not respected.”

At least in the EU these new regulations will force the LNG industry to reduce its emissions. It is likely that after COP28 in Dubai there will be a refocus on lowering methane and CO2 emissions, increasing demand for low-emission LNG.