A falling market [NGW Magazine]

Natural gas had a difficult time in 2019, with a global oversupply keeping prices low, even though demand kept on increasing. Much the same is expected in 2020, with a glut of LNG threatening shut-ins.

In Europe, major changes are afoot with the European Green Deal expected by March, setting the framework for energy developments over the next 30 years, with net-zero emissions by 2050 to be enshrined into law.

In Asia, energy security forces and increasing reliance on domestic resources unleashed by the US-China trade war will continue to haunt LNG export markets, contributing to the global LNG glut and low prices.

Despite the Phase 1 agreement – that diffused tension but delivered very little substance – divergence between China and US in trade and technology will continue and is likely to become more acute in 2020, even if further trade deals are reached. And it is not just China: Europe, Brazil, Argentina and France have also been facing added US levies. Trade tensions create uncertainty and dampen growth, impacting global energy markets.

Global economic growth is expected to stay low in 2020 at 3.2%, unchanged from 2019. Other factors are how Brexit will unfold, the slow growth in the Chinese economy, expected to slow down to 6% in 2020, and mounting challenges to the Indian economy.

In fact, China’s premier, Li Keqiang warned: “Next year, our country’s economy could face greater downward pressure…We will face a more complex situation, and governments at every level will have more difficult tasks, and greater responsibilities.”

As the country realigns from low-value exports to internal consumption, high-tech manufacturing and services, China’s reaction will matter greatly to the global economy and energy markets in 2020.

In addition, growth in emerging markets slowed significantly in 2019, and according to Moody’s this slowdown may increase in 2020 owing to uncertainties surrounding trade, politics and policy. Growth will also be slow in the OECD advanced economies, expected to be less than 1.6%. These factors are likely to affect oil and gas demand in 2020.

Subdued oil prices

The Opec+ group of oil producers agreed in December to extend and deepen production cuts by another 0.5mn b/d to March 31, 2020. But with global economic growth continuing to be slow in 2020 – impacting demand – this is not expected to be sufficient, leading to surplus production and low prices.

Acknowledging the challenges ahead, Opec said in its World Oil Outlook released in November that it expects its own production of crude oil and other liquids to decline from 35mn b/d in 2019 to 32.8mn b/d by 2024.

US crude oil and condensate production is also likelyto decline in 2020 owing to lower prices, tighter lending in the shale sector and reduced spending, down to 13.1mn b/d in comparison with 13.5mn bls/d in 2019.

But other, non-Opec, oil producing countries such as Brazil, Guyana and Norway are expected to more than make up for it, producing additional volumes that will meet global demand in 2020. The International Energy Agency (IEA) says that this could be as much as 2.3mn b/d, leading to anexcessof crude in 2020.

As a result of the slowing global economic activity, global oil demand growth is expected to be anaemic in 2020, with some forecasts expecting it to be near 1.1million b/d, keeping prices down. But if the US-China trade war is not fully resolved soon, combined with weaker global economic growth, according to Fitch it may bring this down to as low as 0.7mn bls/d.

Dwindling growth in oil demand may be a prelude to its eventual plateauing within the next decade, as predicted in November by the IEA.

These developments will impact oil prices in 2020, with Brent crude likely to average $62.50/b according to a poll of 42 economists and analysts. Despite Opec production cuts, this is less than the $64/bl average in 2019. But if the lower demand estimates materialise, it could go nearer the $60/bl range, impacting oil-linked LNG prices.

Subdued gas prices

Natural gas demand will carry on growing in 2020, but LNG demand growth will slow down. Even though global LNG exports will continue to grow, it will not be as fast as it has been in previous years.

As a result of the trade war with the US, China has made energy supply security top priority, favouring domestic energy production. This, slower economic growth, regasification capacity limitations and ramping up of gas supplies from the Power of Siberia pipeline, will impact Chinese LNG imports, limiting growth for the second year running.

Japan and South Korea are also expected to see little change in LNG imports during 2020, even as the world is still trying to deal with the open-ended glut in LNG supplies. As a result, with the demand outlook subdued, Asia-Pacific will remain oversupplied, with diversions of LNG to Europe expected to continue during 2020.

But with gas storage still very full, economic growth stagnating, and the winter being so far mild, Europe’s ability to absorb diverted LNG may be more limited in 2020, which may cause US LNG shut-ins.

In addition, the just-agreed Gazprom-Ukraine deal means that there will be no disruptions in the supply of Russian gas to Europe, which could grow depending on the progress with Turk Stream 1 & 2 and Nord Stream 2.

In the meanwhile, global gas liquefaction capacity is expected to carry on increasing, by about another 30mn mt/yr in 2020 – mostly in the US, Australia and Russia – on top of the estimated 35-40mn mt/yr increase in 2019.

The IEA expects the liquefaction capacity construction spree between 2016 and 2020 to slow down after 2020 (Figure 1) – (this does not include the new capacity additions announced by Qatar and Novatek). As much as 1,100mn tons of new capacity is estimated to be at various stages of approval, with most in the US, chasing an expected increase in demand of the order of 100-150 mn mt/yr by 2030.

Given the state of the global LNG market, much of this will not progress to construction due to the challenges of finding anchor buyers and securing finance. But even then the glut in LNG supplies may continue well into the next decade, with LNG facing continuous uncertainty and volatility.

This is confirmed by Oxford Institute of Energy Studies (OIES), which calculates that new liquefaction FIDs reached in 2019 totalled 63mn mt/yr – excluding Nigeria’s 7.6mn mt/yr, sanctioned in the closing days – and expects more than 40mn mt/yr to be added in 2020.

The result of these will be an oversupply of gas with prices staying low for another year, likely to average below $4/mn Btu next summer, both in Europe and Asia. In the US the Energy Information Administration (EIA) projects that due to record production of natural gas in 2020, prices at Henry Hub will fall, averaging about $2.60/mn Btu. 2020 will be the second year of low commodity prices, following low prices in 2019 (Figure 2).

On the positive side, low LNG prices may stimulate new gas demand as well as displace coal, especially in countries that cannot afford high energy prices. This is especially so in south Asia, where infrastructure is improving and could support LNG import growth. The existing LNG buyers’ market looks set to continue into 2020.

A glut of energy supplies

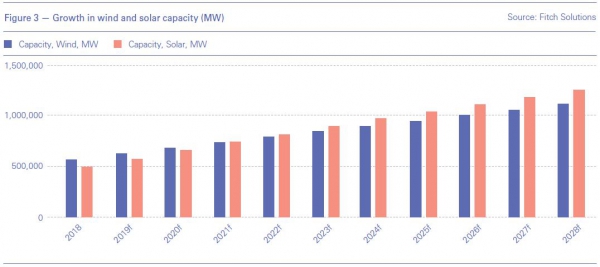

Renewables penetration will continue growing globally at a rapid pace (Figure 3). Technological improvements, such as larger offshore wind turbines, increasingly efficient solar panels, cheaper batteries, and continuously declining costs will drive renewable energy development during 2020.

Some forecasts expect that renewable energy generation growth will outpace that of gas by a factor of four. China alone is expected to add another 40 GW of solar power in 2020. As a result, the world will continue to experience an energy supply glut, with global energy markets remaining highly competitive and prices persistently low.

Global oil and gas markets will continue to be well supplied in 2020, with demand increases not matching supply. As a result, oil and gas prices will continue to remain low and largely decoupled from geopolitical risk.

Global power demand

Global power demand will carry on increasing in 2020 driven by population growth and rise in living standards in Asia, particularly in China and India, and in the Middle East and Africa.

The increase will come from more renewables, more gas and more coal, with renewables likely to account for two-thirds of new power generation capacity in 2020. In addition, the use of batteries to absorb power supplies during peak generation and release these supplies during peak demand will continue to increase, with uncertain impacts on gas-fired peaking plant.

Low prices will continue to improve LNG competitiveness in the power sector in developing countries, especially in Asia, contributing to LNG demand in 2020.

Low prices are also helping increase the share of natural gas in power generation in the US, replacing falling coal power. The EIA expects this share to be over 35% in 2020.

With electricity demand expected to outperform other energy sectors, power generation from renewables and natural gas is attracting the interest of and investment from international oil and gas companies (IOCs) keen to bolster their green credentials.

But with its emphasis on energy security, coal power will continue being a top priority in in China in 2020, impacting coal-to-gas switching and reducing LNG import growth further.

On the other hand, coal-fired power generation will continue facing pushback in developed markets. But new coal-fired power projects in smaller developing markets will face headwinds from the financial sector that is extricating itself from the dirtiest of the fossil fuels.

Climate change

Climate change moved to the top of global political debate in 2019, culminating in the UN climate action week in September and COP 25 in December, with a dramatic shift in public opinion.

But after the failure of COP 25 to arrive at a consensus on new, more ambitious, climate targets, COP 26 is not expected to fare any better. US resistance and unwillingness by China and India to curb energy demand and increase their climate commitments will limit achievements. Global energy consumption and carbon emissions will continue to increase, with more extreme climatic events feeding increasingly polarized environmental activism and protests in 2020.

In response to the increasing pressure owing to climate change, both from consumers and investors, there will be an increased push towards sustainability in the international oil, gas, and chemical sectors in 2020.

Even though this is not new to the industry, investment in renewables and in low carbon energy companies will increase in 2020 and will constitute a higher proportion of total capital expenditure than this year.

This will include Investment in renewable energy generation capacity, low carbon transport, electric vehicle charging, biofuels and carbon capture technology, as companies seek to diversify their value chains.

The industry will be acting on its pledge to reduce its carbon footprint, and the impact of its operations on greenhouse gas emissions and find its position in the global energy transition. But litigation and divestment risks will continue. The industry will have to convince society that it is part of the solution and not part of the problem.

Annual results to be released early in 2020 will demonstrate how the industry is responding to sustainable investments and risks. EU regulation that came into force in 2019 makes it mandatory for publically quoted companies to disclose how they incorporate such risks into their investment decisions and products.

In 2020 the gas and LNG industry will need to work harder to demonstrate the benefits of natural gas to energy transition and its environmental credentials.

European Green Deal (EGD)

This will probably be the most important development in Europe’s energy sector in 2020, accelerating change and setting the tone and direction for the next 30 years.

Achieving carbon neutrality by 2050 will require a complete transformation of EU’s economy, with the crucial decisions to be taken during the next few years. It is an ambitious undertaking, but necessary.

Its main aims include Europe becoming the first climate-neutral continent, enshrining a 2050 climate-neutrality goal into law and setting-up a new carbon reduction target for 2030 to at least 50%. This will require tougher environmental standards. In addition, the European Investment Bank will be turned into the European Climate Bank, ceasing support of fossil fuel projects after 2021.

In order to protect EU industry from cheaper imports from countries that do not tax carbon emissions, EGD looks set to introduce a border carbon tax. This is bound to cause controversy with Europe’s trading partners.

EGD expects decarbonisation of natural gas across the full value chain, with consumption of unabated gas virtually eliminated by 2050. The impact of this will start being felt after publication of the report in March. It will prompt the energy industry to carry out strategic reviews starting 2020.

But it will not be plain sailing. It is likely to attract considerable resistance within Europe, and outside, once the challenges and cost implications become better understood.

The Green Deal will be the main flagship of the new European Commission and it is expected to have a tremendous impact on the future of energy, including gas, in Europe. Its impact will start being felt in 2020, in preparation for COP26 in November in Glasgow. But whether the European population at large will welcome the implications as loudly as the EC has, is doubtful.

Could there be surprises?

There may be potential surprises in 2020 that could potentially disrupt and change the outlook for energy.

Saxo Bank predicts: "In 2020, we see the tables turning for the investment outlook as Opec extends production cuts, unprofitable US shale outfits slow output growth and demand rises from Asia once again. And not only will the oil and gas industry be a surprising winner in 2020 – the clean energy industry will simultaneously suffer a wake-up call." Even though this may sound unlikely, a report published by the IEA in 2019 sounded a warning, by concluding that in 2018 “capital spending on oil, gas and coal supply bounced back while investment stalled for energy efficiency and renewables.”

Should Elizabeth Warren win the 2020 US elections, her promise to put a “total moratorium on all new fossil fuel leases for drilling offshore and on public lands” and “ban fracking everywhere” on her first day in office could have a major impact on energy supply and security in the US, but also globally. With renewables not yet in a position to fill the gap, would this mean more coal and more nuclear?

More generally, a Democratic win at the November 2020 US presidential election could bring major shifts in US energy strategy that could impact global energy developments. These include the possibility of more interventionist climate policies, re-signing the Paris Agreement, taking a different direction in the US-China trade dispute from Donald Trump, moving away from the ‘America-first’ US foreign policy, closer co-operation with Europe and sorting out sanctions on Iran and Venezuela.

Even though the possibility of a war with Iran is low, geopolitical disruption risk in the Middle East region has not disappeared. This is also the case in the eastern Mediterranean, where Turkey has been raising the ante through intimidation and not heeding widespread condemnation. But so far a hot incident has been avoided.

Other potential surprises include persisting US-China trade tensions, no-deal Brexit and India’s economic and political problems getting out of hand. These could increase uncertainty and still have unforeseen consequences for the global energy, industries in 2020.

_f650x339_1579010892.JPG)