A different future [NGW Magazine]

Published later than usual, in September rather than February, the UK major BP’s Energy Outlook 2020 does not only manage thereby to cover the Covid-19 pandemic on future energy demand and supply. It also provides a backdrop to the new CEO Bernard Looney’s deliberately radical reinvention of the international oil company into an international energy company.

EO 2020 investigates possible paths for the global energy transition: how global energy markets may evolve in the period to 2050; and the key uncertainties that may shape them. BP states that it does not provide forecasts – chief economist Spencer Dale made it as clear as he could that the reality would turn out different – but it is to help the reader understand the scale of the uncertainty that the move to decarbonise has created.

EO 2020 considers three main scenarios:

- Business as usual (BAU) assumes that government policies, technologies and societal preferences continue to evolve in the manner and speed of the recent past.

- The Rapid scenario assumes the introduction of policy measures, led by a significant increase in carbon prices. These result in rapid reductions in carbon emissions from energy and are broadly consistent with limiting the rise in global temperatures by 2100 to well below 2 °C above pre-industrial levels.

- Net Zero assumes the policy measures of Rapid are reinforced by significant shifts in societal and consumer behaviour and preferences. This is broadly consistent with limiting temperature rises to 1.5 °C.

Key findings are:

- Global energy demand grows in all three scenarios driven by increasing prosperity and living standards in the emerging world, plateauing by the mid-2030s in Rapid and Net Zero as improvements in energy efficiency accelerate. In BAU, demand continues to grow, gaining about a quarter more by 2050.

- The transition to a lower-carbon energy system results in a restructured and more diverse energy mix. All three scenarios see a decline in the share of hydrocarbons, from around 85% in 2018 to between 65% to 20% by 2050. There is a corresponding increase in renewable energy – between 20% to 60% – as the world uses more electricity.

- All scenarios see oil demand fall over the next 30 years driven by the increasing efficiency and electrification of road transportation: 10% lower by 2050 in BAU, after plateauing in the early 2030s; around 55% lower in Rapid; and 80% lower in Net Zero.

- The outlook for global gas demand varies significantly across the scenarios. It peaks in the mid-2030s and declines to 2018 levels in Rapid. But in Net Zero It peaks earlier, in the mid-2020s, and by 2050 is around a third lower than in 2018. In BAU, gas demand increases throughout the next 30 years to be around a third higher by 2050.

- Natural gas can potentially play two important roles in an accelerated transition to a low-carbon energy system: supporting a shift away from coal; and combined with carbon capture, use and storage (CCUS) as a source of near zero-carbon power. Gas combined with CCUS accounts for between 8% to10% of primary energy by 2050 in Rapid and Net Zero.

- Wind and solar are the fastest growing source of energy over the next 30 years in all the scenarios, with the share of primary energy from renewables growing from around 5% in 2018 to 60% by 2050 in Net Zero, 45% in Rapid and 20% in BAU, underpinned by continuing falls in development costs.

- By 2050 the share of electricity in total final consumption increases from a little over 20% in 2018 to 34% in BAU, 45% in Rapid and over 50% in Net Zero, dominated by renewable energy. But the intermittency associated with the growing use of wind and solar power means a variety of different technologies and solutions are needed to balance the energy system and ensure the availability of reliable power.

- The changing fuel mix, combined with the increasing use of CCUS, sees carbon emissions from the power sector decrease by over 80% in Rapid, compared with just 10% in BAU.

- The Rapid scenario leads to carbon emissions from energy use falling by around 70% by 2050, from 2018 levels, and by more than 95% for Net Zero. In BAU, carbon emissions from energy use peak in the mid-2020s but do not decline significantly, with emissions in 2050 less than 10% below 2018 levels.

- The use of hydrogen goes up in the second half of EO 2020 in Rapid and Net Zero, particularly in activities which are harder or more costly to electrify. By 2050, hydrogen accounts for around 7% of final energy consumption in Rapid and 16% in Net Zero.

- The shift away from traditional hydrocarbons also leads to an increasing role for bioenergy. It accounts for around 7% of primary energy in Rapid and almost 10% in Net Zero by 2050.

BP says the world is on an unsustainable path and the scenarios show that achieving a rapid and sustained fall in carbon emissions is likely to require a series of policy measures, led by a significant increase in carbon prices. These polices will need to be further reinforced by shifts in societal behaviours and preferences – something which is proving to be a big challenge, especially in Asia. BP says that delaying these policies, measures and societal shifts may multiply the challenge, so creating significant additional economic costs and disruption.

In his introduction, Looney says that how the global energy system will change out to 2050 will be driven by three key factors:

- The energy mix will become more diverse, driven more by customer choice rather than by what fuels are available.

- Markets will need more integration to accommodate this more diverse supply and will become more localised and competitive as the world electrifies and the role of hydrogen expands.

- The centre of gravity of energy markets will shift towards consumers and away from traditional upstream producers.

He added that EO 2020 was instrumental in BP’s strategy, announced in August, that is based on achieving net zero by or before 2050.

Global energy demand

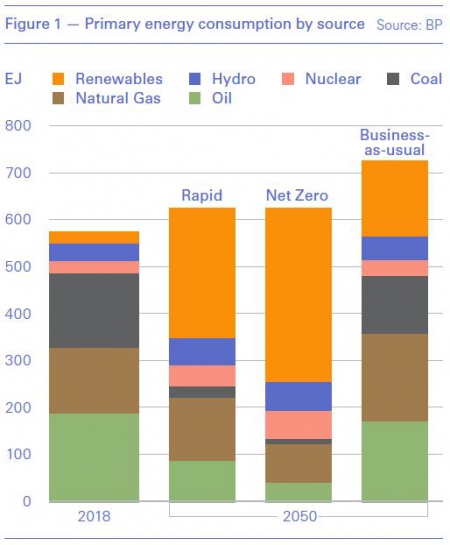

Primary energy demand increases by about 10% in Rapid and Net Zero and by about 25% in BAU over the period to 2050, driven by increasing levels of prosperity in emerging economies (Figure 1) .

Predictably, in Rapid and Net Zero the contribution from renewable energy grows rapidly – from 5% in 2018 to 45% and 60% respectively in 2050 – at the expense of fossil fuels.

The scale of the economic cost and disruption caused by Covid-19 is likely to have a significant and persistent impact on the global economy and energy system. It will cause lasting behavioural changes affecting work, leisure and travel. This could potentially reduce primary energy demand in Rapid by 3%-8% by 2050.

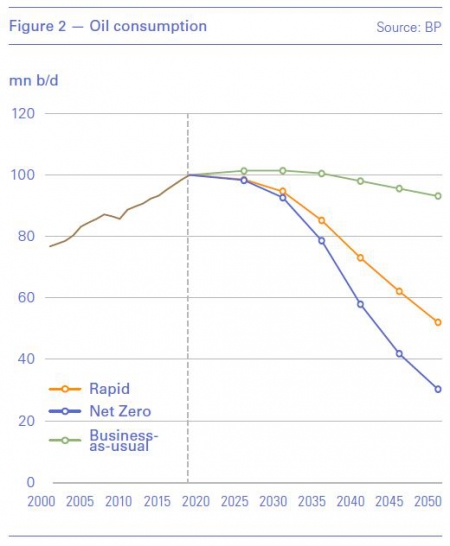

The growth of energy used in transportation slows, with oil peaking in mid-to-late 2020s in BAU(Figure 2).

In BAU oil consumption sees only a small reduction by 2050, but the drop in Rapid and Net Zero is pronounced: down to about 50mn b/d and 40mn b/d respectively. This is due to electrification and better fuel efficiency.

Global coal demand declines consistently over the next 30 years in all three scenarios, particularly in Rapid and Net Zero (Figure 1).

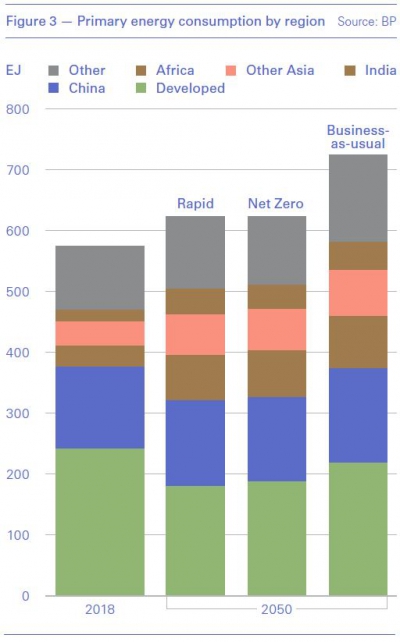

In 2018, the average person in the developed world used more than three times more than his counterpart in emerging economies. At the extremes, an average US citizen used 12 times more energy than an Indian. As populations expand and grow richer, this gap narrows, affecting global energy demand.

Covid-19 however is leading to deglobalisation. The disruptions associated with this, together with the increase in trade disputes and sanctions in recent years, are leading to rising concerns about energy security – particularly countries that import much of their oil and gas.

In response to this, countries are trying to rely less on imported goods and services, giving priority instead to domestic energy resources. This includes all fuels, including coal.

Deglobalisation could reduce China’s net imports of oil and gas in 2050 by as much as 30% in Rapid. Likewise, US net exports of oil and gas could be 50% lower by 2050.

Impact on natural gas

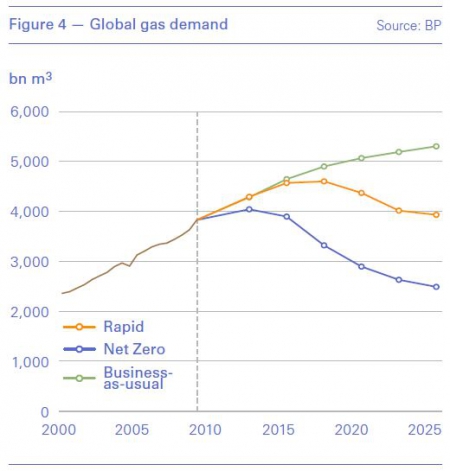

Natural gas is more resilient than either coal or oil, owing to its broad-based demand and the increasing availability of global supplies (Figure 4).

In Rapid, global gas demand, including biomethane, grows over the next 15 years, driven primarily by economies in developing Asia switching away from coal towards lower-carbon fuels. Global gas consumption declines in the subsequent 15 years as coal switching fades, compounded by increasing falls in the developed world, falling back close to 2018 levels at around 4 trillion m³.

In contrast, gas demand increases throughout the next 30 years in BAU, increasing by a third to around 5.3 trillion m³ by 2050. This growth in gas demand is relatively widespread, with particularly strong increases across developing Asia, Africa and the Middle East.

US, Middle East and Africa supply most of the extra energy needed in BAU: their rising output together accounts for around two-thirds of the incremental supply.

In addition to supporting a shift away from coal, natural gas has a role to play as a source of near zero-carbon power when combined with CCUS, either as a direct source of energy to the power and industrial sectors or to produce blue hydrogen, provided prices remain competitive.

LNG grows substantially, increasing the accessibility of gas worldwide, leading to a more competitive, globally integrated gas market.

This fast growth is driven by increasing gas demand in developing Asia as gas is used to aid the switch away from coal and LNG imports are the main source of incremental supply. US, Africa, Russia and the Middle East meet most of the demand surge, driven by low prices, and they emerge as the main LNG exporters. Deglobalisation would, of course, impact this.

But natural gas still needs to seriously address flaring and methane leaks that tarnish its image as the cleanest of fossil fuels.

The rise of renewables

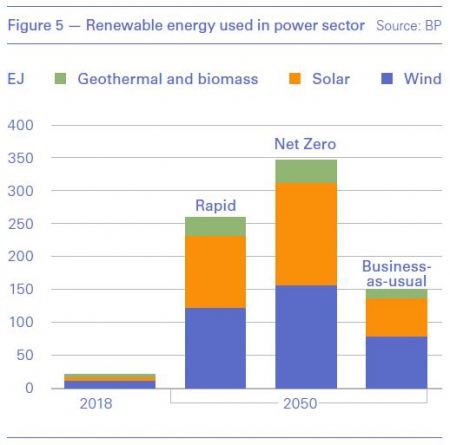

Renewable energy in power grows quickly in all three scenarios (Figure 5), driven by wind and solar power, aided by falling costs of production and policies encouraging a shift to lower-carbon energy sources.

The share of renewables in primary energy grows from around 5% in 2018 to 45% by 2050 in Rapid and 60% in Net Zero.

Emerging economies account for the majority of the growth in renewable energy in each of the three scenarios, driven by stronger growth in power generation and by the increasing share of renewables in power. Coal is seen as the major loser.

The average annual increase in wind and solar capacity in Rapid and Net Zero over the first half of the Outlook is around six to nine times faster than the annual average since 2000. A challenge is that this would require a significant increase in investment spending. The average annual investment in wind and solar capacity implied by Rapid in the period to 2050 is between $500bn and $600bn, while for Net Zero it is between $650bn and $750bn. These are 2 to 2.5 times greater than the average annual investment in the five-year period to 2018, which was about $300bn.

A significant share of wind and solar energy is used to produce green hydrogen in Rapid and Net Zero, with this share increasing to around a fifth of total installed capacity by 2050 in Rapid and to around a third in Net Zero. By 2050, hydrogen accounts for around 7% of non-combusted total final energy consumption in Rapid and around 16% in Net Zero.

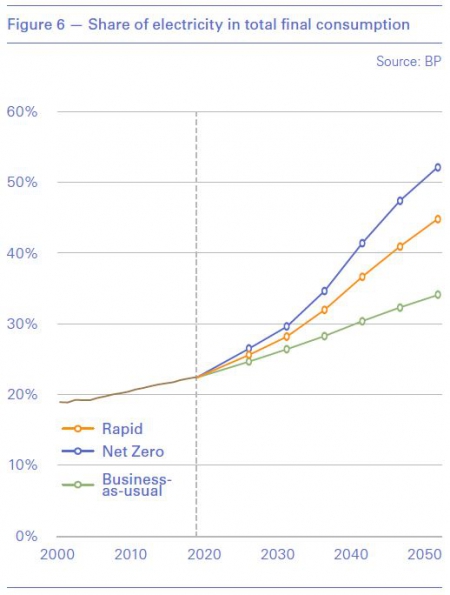

The world continues to electrify (Figure 6), leading the power sector to play an increasingly central role in the global energy system.

The extent to which the energy system electrifies is greatest in Rapid and Net Zero as progressive decarbonisation means more electricity at the point of consumtion. It increases from a little over a fifth in 2018 to 45% in Rapid by 2050 and over 50% in Net Zero, compared with just 34% in BAU. The growth of electricity demand in BAU is supported by stronger overall growth in energy consumption than in the other two scenarios.

The energy required to meet the growing use of electricity for final consumption is the dominant source of incremental demand for primary energy in all three scenarios. As a result, the share of primary energy that is absorbed by the power sector increases from 43% in 2018 to around 60% by 2050 in Rapid and Net Zero and to a little over 50% in BAU.

Carbon emissions

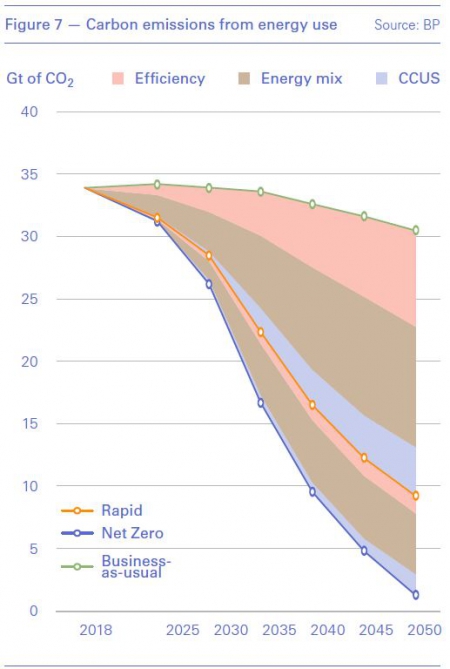

Carbon emissions fall significantly in Rapid and Net Zero, by 70% and 95% respectively by 2050 in comparison to 2018. In BAU emissions peak around the mid-2020s and decline only gradually, falling to around 10% below 2018 levels by 2050 (Figure 7).

The fall in emissions in Rapid and Net Zero is driven by switching to low-carbon energy, greater gains in energy efficiency, and growing use of carbon capture technologies (CCUS).

Challenges

EO 2020 acknowledges that there may be economic and political limits to the extent to which an accelerated energy transition can be driven solely by government policies. It assumes that the impact of these polices will be augmented by the changing behaviour and preferences of companies and consumers in switching to low carbon energy sources. But is such assumption valid globally?

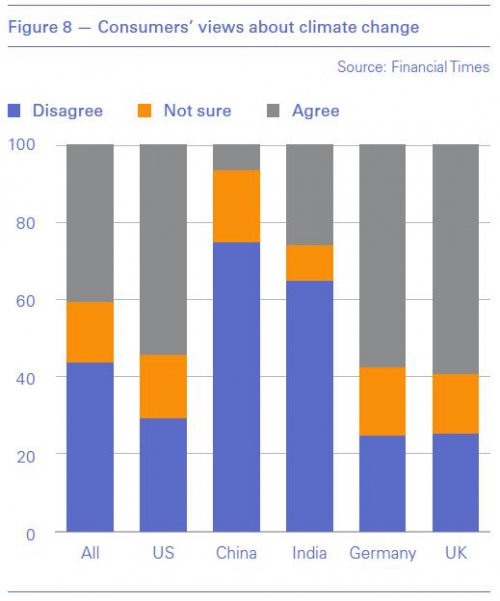

One of the biggest challenges is the dichotomy that is developing between consumers’ climate perceptions in the developed economies and countries in Asia, particularly in China and India. In a recent survey close to 75% of respondents in China agreed with the statement: “The effects of climate change are too far in the future to worry me,” with barely 6% disagreeing. The numbers for India were about 65% and 25% respectively (Figure 8). Globally opinion was split. Clearly, while consumers in the richer developed world may be willing and afford the cost of making climate change a high priority, the same does not apply to Asia.

Fast-growing economies and increasing populations mean that Asia’s energy needs cannot be provided by renewables alone, but will also need gas, coal and nuclear. Between them, China and India account for about 28% of global energy demand, expected to grow to about 33% by 2050 in all scenarios – by then Asia’s share will grow to about 43%. In addition, about 75% of the growth in energy demand between now and 2050 will come from Asia.

Combined with the economic impact of Covid-19 and security of supplies concerns, both China and India are prioritising domestic energy resources, including renewables but also coal. Should climate change – in contrast to clean air which continues to be high priority – continue to play second fiddle to security of supplies and economy concerns in these countries, and in Asia in general, the likelihood of Rapid and Net Zero scenarios materialising will be small. Then there is the question of the November US presidential elections and the incumbent’s views on the environmental question.

It is often stated that effective transition to clean energy will need decisive policy measures, including substantial increases in carbon prices. But apart from Europe, such policies may be difficult to implement anywhere else, possibly impacting the extent and effectiveness of transition.

The challenge then for BP is to convince its investors that cutting oil production by 40% and increasing its renewables spending by a factor of ten in the period to 2030 will work. Presenting this, Looney said “Our new strategy is going to transform BP into a very different company. Not overnight, given our size and scale. But fast, because the world needs change.”

Undoubtedly renewables will be the fastest growing energy source. But, depending on what happens in Asia, demand for fossil fuels is expected to remain strong for some time – likely somewhere between BAU and Rapid estimates. Even Looney said that no matter what trajectory a transition to cleaner fuels takes, “hydrocarbons do continue to play a role” in the future. He added: “In 2030, BP will still be a major producer of hydrocarbons.”

As the world goes forward, energy may be dominated by renewables and gas. But Asia’s growing energy needs mean that other sources of energy will still have a serious role to play during the next few decades.