Asian LNG demand prospects [Gas In Transition]

Asian gas demand has been one of the main drivers of developments in the global LNG market since its inception. The region consumed more than 70% of the 488bn m3 or so of global LNG in 2020 and has more often than not determined the price and terms on which it is sold.

That will not necessarily change in the long term, but in the near term the certainties resulting from Asia’s traditional dominance of the market have been thrown into disarray by Russia’s invasion of Ukraine. With supply from North America to Europe taking centre stage, Asian countries are scrambling to reposition themselves in the LNG and wider energy markets.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Sagging gas demand

In the short term, the impact of the war will be limited in most Asian countries, especially those primarily supplied with LNG under long-term contracts. The fundamental restructuring of gas supply planned in much of Europe is unlikely to be realised either as quickly or completely as hoped, but it will not be business as usual for Asia.

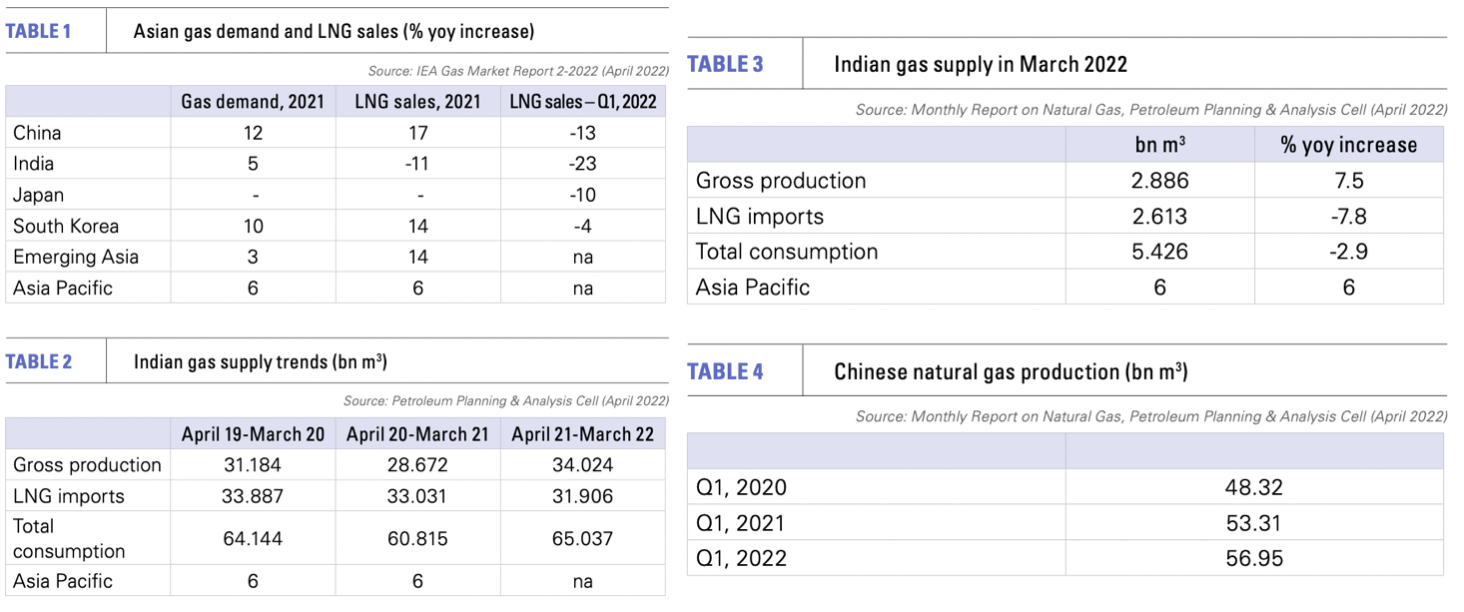

In its April 2022 Gas Market Report, the International Energy Agency (IEA) projected that Asian gas consumption will rise by only 3% in 2022 – down from its earlier expectation of 5% growth and the 7% increase recorded in 2021 (see table 1).

That said, the downtick in Asian gas demand growth had begun before the start of the Russo-Ukrainian war. Growth rates varied across Asia in 2021, with much of the increased demand being concentrated in China and South Korea. But even there the extreme level and volatility of LNG spot prices was having a marked impact on consumption by fourth-quarter 2021.

Chinese gas demand grew by only 3% year on year in the fourth quarter, compared with 16% in the first three quarters of 2021, with “price-driven demand destruction (especially in the industrial sector)” being compounded by slowing economic growth and relatively mild winter temperatures, according to the IEA.

In addition, the overarching consequences of the Russo-Ukrainian conflict for the global gas market will be exacerbated or offset by developments specific to Asia. Apart from the typical fluctuations in demand related to weather, these include factors such as the resurgence of COVID-19 in China and incidents like the recent earthquake in Japan.

China’s zero tolerance COVID policy resulted in the return of stringent lockdowns from March. Combined with mild temperatures, the disruption this caused to economic activity meant Chinese gas demand grew by only 4% year on year in the first quarter of this year.

The IEA projects that Chinese gas consumption will increase by 7% in 2022, down from 12% growth in 2021. Even so, the IEA expects that China will account for virtually all the net gas demand growth of 3% it projects for Asia in 2022. Elsewhere, it projects modest demand growth in India (2%) and emerging Asia (<2%), offset by declines in Japan (-2%) and South Korea (-8%).

The 7.4 magnitude earthquake which struck offshore Fukushima in Japan in March, meanwhile, resulted in the closure of just over 6 GW of coal, gas and oil-fired generation plants at a time when Japanese gas stocks were low and temperatures still cold. The shutdowns again focused attention on the supply security which a higher rate of nuclear restarts would provide.

Impact on LNG demand

The slowdown in gas demand has already affected LNG purchases. Asian imports fell by 10% year on year in the first quarter of 2022, according to figures cited in April by Wood Mackenzie. The consultancy forecasts that Asian LNG imports in calendar 2022 would be flat at 270mn mt.

China became the world’s single biggest LNG importer in 2021, with imports of 78.93mn mt, including up to a third bought on a spot basis. But Chinese buyers have been largely absent from the spot market this year, with overall LNG purchases down 13% year on year in the first quarter. These trends led Wood Mackenzie to revise its earlier expectation that imports in 2022 would increase by 10mn mt to a projection of no growth.

Indian LNG imports slumped 23% year on year in the first quarter, following a 20% fall in the fourth quarter. However, a March 2022 analysis by the local rating agency Crisil projected that gas demand in the year to March 2023 could rise 12-14% based on increased use by consumers such as fertiliser manufacturers whose operations are underwritten by state subsidies. However, it did note that spot LNG purchases, which account for 10-15% of demand, would likely fall.

Japanese LNG imports fell slightly to 74.32mn mt in 2021, before falling 10% year on year in the first quarter of 2022. LNG use had fallen in the power sector in 2021 largely due to several reactor restarts. While the IEA projects that nuclear output will remain flat in 2022 after a 42% jump in 2021, the country’s slow growth in energy demand and planned start-up of several coal-fired generators could put downward pressure on gas and thus LNG demand.

In South Korea, LNG imports fell by 4% on year in first-quarter 2022, according to the IEA. They are expected to fall further in 2022 as the commissioning of coal-fired and nuclear units displaces output from gas-fired generators.

Developments in other parts of Asia show a mixed picture. Strong growth in gas demand in 2022 is expected in several countries, notably Indonesia. However, gas use in key LNG importing countries such as Thailand, Pakistan and Bangladesh could well fall or at best stall as a result of high prices.

Beyond 2022

How Asian LNG demand develops after 2022 is uncertain. But what is clear is that any country hoping for a near-term return to the status quo ante of plentiful LNG supply and low prices will be sorely disappointed.

The burgeoning needs of European countries look set to dominate the market for several years to come, while the lead times needed to bring new LNG supply on line are significant. Even where brownfield or new liquefaction capacity can be rapidly commissioned, priority may be given to supplying the fuel to Europe by some exporting countries, such as the United States.

However, it also seems likely that most of the countries relying on additional domestic gas production will be disappointed. In very few instances will new investment in existing fields result in sufficient gas to meet long-term growth in demand.

While a substantial number of untapped gas resources across Asia look economically attractive at current prices, the time needed to finance and implement them could be considerable, especially given the legal and regulatory complexity of exploration and development in many Asian countries. On top of this, the ownership of some of the most prospective offshore gas resources is hotly contested.

Increased piped gas imports are an option in cases where the infrastructure already exists, notably the delivery of gas from Central Asia and Russia to China. However, as in China or Thailand, these projects are often integrated into a national gas delivery system also predicated on gas supply from LNG terminals.

In any case, there is limited spare capacity at most operational pipeline projects, while further developments face the same issues of long lead times, cross-border risk, and unhelpful legal and regulatory regimes that affect the financing and development of many gas fields. Indeed, the issues impacting pipeline projects, such as the Turkmenistan-Afghanistan-Pakistan-India pipeline, have proved more intractable than for most gas field developments.

Gas or coal?

For many Asian countries limited gas options will force reliance on other fuels, in particular coal. Increased output from coal-fired generators is already occurring or planned in countries including China, India, Japan, South Korea, and Indonesia and other parts of Southeast Asia.

The nuclear restart option is more niche, but could form a significant part of Japan and South Korea’s response. Building new renewable capacity may be an option in a few cases, given the short lead times and cost competitiveness of many projects. But in most Asian countries their near-term potential is currently limited, meaning the only realistic immediate option for replacing LNG is coal.

This will in turn require increased domestic coal output or imports. Increased output could face environmental opposition, while import availability could be an issue following Indonesia’s decision to divert coal exports to domestic consumers.

Increased coal burn also depends on an existing stock of mothballed or under-utilised plants, which is not an option for generation-strapped countries such as Pakistan and Bangladesh. Here the only choice may be to stick with expensive LNG or switch to equally expensive oil products.

The way forward

While it will cause short-term pain in much of Asia, the upheaval in the global LNG market has at least provided a stark demonstration that the alternatives to LNG are severely limited, both now and for the foreseeable future. LNG is integral to the regional energy economy, with most Asian countries likely to adopt short-term fixes – more often than not coal – until new LNG supplies become available.

Given the lack of alternatives, the substantial existing investment in Asian gas infrastructure, and the current high price of LNG, those supplies are likely to be forthcoming. Financial investors and LNG consumers both have a strong impetus to promote new, Asia-focused liquefaction capacity. Asian buyers have already stepped up their interest in new US LNG developments, signing a number of off-take agreements in recent months.

Substantial new LNG supplies will take several years to arrive, and require innovative contractual approaches to meet the demands of suppliers and importers. However, from the mid-2020s, it seems likely that Asian LNG demand will be back on a strong growth trajectory. Demand could rise from 270mn mt in 2022 to 380mn mt in 2030, according to Wood Mackenzie, with substantial additional supplies from Australia, the US, Qatar and elsewhere on the cards.