LNG comes of age [NGW Magazine]

Most self-respecting energy companies have an LNG strategy: transport, power and industry cannot reduce their emissions affordably without gas.

From being a niche fuel confined to highly profitable projects servicing captive markets, LNG is now democratic, even being trucked from terminal to filling stations almost as if it were diesel. With decarbonising the ultimate goal of politicians, LNG is the fore-runner of green gas, developing the markets while the even cleaner technology is being perfected affordably. Electrification will not do the job of heating homes or transporting heavy goods.

This conviction perhaps explains why term contracts to purchase liquefied natural gas have lengthened. They have doubled in their average duration to over 13 years in 2018, senior executives at Anglo-Dutch major Shell told journalists February 25. This is seen as a sign of long-term commitment as buyers do not want to risk going short in the future and having to rely on the spot market for the much-in-demand fuel.

Its director of integrated gas and new energies Maarten Wetselaar and executive vice-president for gas and energy marketing and trading Steven Hill said that three mega-trends – global population growth adding another China and India, climate change abatement and air quality measures – were driving gas demand. Gas is clean, abundant and affordable, and so today’s demands are a “fantastic platform for growth.”

Gas is underweight in the global energy mix: while its share of the average primary energy is 23%, that percentage plummets if the US and former Soviet Union are removed, with the major and rapidly growing markets of India and China both in single figures. That implies a vast potential for growth, the executives said.

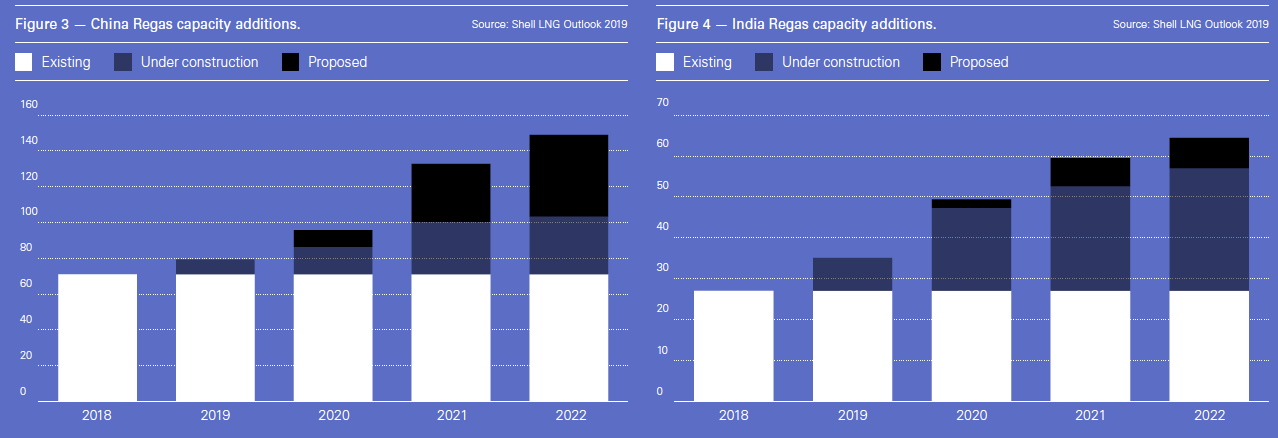

But the cost of that gas will influence the outcome and both countries are seeking to boost domestic gas and retain more value for their own economies (see feature on India and box below on G3 in China).

South Korea has begun to tax coal more than three times as much as gas on a $/mn Btu basis, having until last year taxed gas more heavily. As an exporting economy, cheap energy – coal – has been essential to its success. Taiwan and Thailand are also pushing an anti-coal or pro-gas agenda.

Low prices but no glut

Spot gas prices are low in northwest Europe for this time of year. At $6.00/mn Btu, US LNG can still make a margin in Europe if the offtakers’ investments in capacity bookings are discounted as sunk costs. But the major believes that a glut has yet to manifest itself; and it is to the long term that it looks when making commitments.

It therefore does not see a drop off in final investment decisions (FID) owing to the spot price. "We take FID based on the mega-trends,” Wetselaar said. He leaves it to Hill’s "very competent" trading division to worry about the near term: that is not what drives the major decision making.

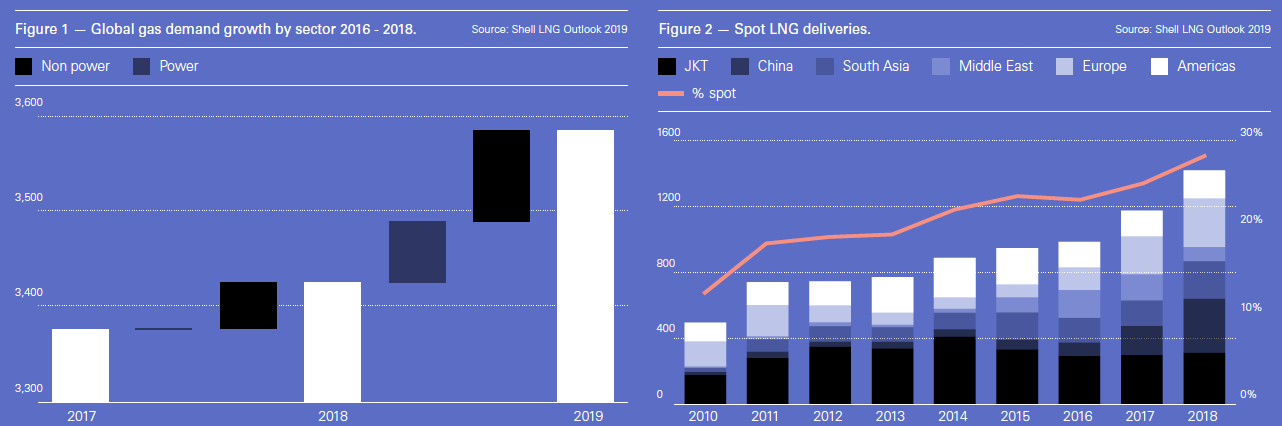

Outlining their reasons for bullishness they said that spot trade was growing and LNG was gaining credibility all the time and that in turn created the necessary confidence to develop demand in new areas such as shipping; as well as in new markets. Last year Bangladesh joined the importers’ club. As for the current low prices, they believe these will prove transient. Buyers are anxious to avoid shortages, as corporate and political strategies depended on accessing the cleanest fossil fuel for years to come.

Hill said that last year, which had been expected to see a glut of LNG on the market, had in fact turned out tight; and more volume had been sold on long-term contracts than in the previous two years combined. He clarified to NGW that those contracts excluded those on which Shell was buying from itself, such as LNG Canada, its LNG project on the west coast on which it is partnered with Petronas, Petro China, Mitsubishi and Kogas.

However there has lately been a surge in LNG deliveries to northwest Europe and that suggests that Asian demand is satisfied.

Shell calls the shots

Shell estimates it sold 22% of the physical LNG market last year, with 71mn mt of the total 319mn mt. Of that, it liquefied 34mn mt; took 25mn mt on offtake agreements and arbitraged another 12mn mt on the spot market.

New LNG projects typically require long-term sales agreements to secure financing, although Wetselaar said that the company did not like to tie FID to long-term contracts, as the buyers could then use that known pressure to take FID in order to negotiate prices downwards.

"We take FIDs when they are optimal, and sign long-tem contracts when that is optimal," he said. LNG Canada took FID with the output to be sold by the partners. The Eni/ExxonMobil-led Rovuma LNG in Mozambique is following a similar model: while the project operators have not yet formally taken the decision to build, all the offtake has been allocated among the partners.

Strong demand for cleaner-burning fuel in Asia continued to drive rapid growth in LNG use in 2018, with global demand rising by 27mn m to 319mn mt, according to this year's outlook. Shell expects demand to reach about 384mn mt next year, as new import capacity comes on line.

“We saw Asian LNG demand growth exceed expectations again in 2018 and we expect this strong growth to continue. Investment in new supply projects is picking up, but more will be needed soon.” LNG has played an important role in the global energy system over the last few decades, as an increasing number of countries have turned to natural gas to meet their growing energy needs. LNG trade increased from 100mn mt in 2000 to 319mn mt in 2018.

Shell still expects supplies to tighten in the mid-2020s. Ongoing efforts to improve urban air quality saw China’s imports of LNG surge by 16mn mt in 2018, up by 40% from 2017.

On the supply side, Australian LNG exports caught up with those of long-time leading supplier Qatar towards the end of 2018 and are expected to rise by 10mn mt in 2019. Australia faces a problem though with its Queensland plants (see box). Nor did the Shell Prelude floating LNG vessel contribute to the country’s surge: for undisclosed reasons it was, at time of press, yet to produce its first cargo.

Queensland faces over-capacity

Australia’s east coast LNG projects face significant headwinds owing to a gas supply shortage, a report published February 21 by consultancy EnergyQuest said. The state faces the partial shut-down of a third of its barely decade-old A$84bn ($60bn) LNG industry by the middle of next decade owing to a gas supply shortage, together with diversions to the domestic market, it said: “This would cut output to four LNG production trains from the current six trains built on Curtis Island off Gladstone by three project owners.”

The three LNG exports projects – ConocoPhillips-Origin Energy Australia Pacific LNG (APLNG), Shell’s Queensland Curtis LNG and the Santos-led Gladstone LNG – rely on coalbed methane (CBM) from the Bowen and Surat Basins, which are a less conventional gas source than feeds Australia’s successful west coast LNG industry. The plants operated at only an average 82% capacity in 2018 of their 25.3mn mt/yr nominal capacity, it said; and they might never actually achieve maximum.

A shortage is expected by 2025 and will be exacerbated by potential political pressure for the LNG operators to divert gas to the domestic market. Gladstone plant shut-downs are not expected to dampen Queensland’s new status as a major global LNG supplier, but its LNG potential has been summed up as “now is as good as it will get.”

“The three Australian east coast projects are all successfully producing, with China the biggest market (70% of 2018 Queensland exports) followed by Korea (16%) and Japan (9%). However, two projects, the Shell-operated QCLNG and the Santos-operated GLNG, are operating well below capacity," said EnergyQuest CEO Graeme Bethune. He said this was owing to upstream gas shortages and diversions to the domestic market. In 2018, QCLNG output averaged 87% and GLNG only 65% of their capacity.

“Queensland will remain a significant LNG exporter, one of the world’s largest, but with more like four trains fully utilised, reducing medium-term exports to around 17mn mt/yr,” he said.

“We have to recognise that the capacity of the east coast’s CBM resource base to feed multiple LNG trains was largely untried. The emerging and critical shortages are resulting from the fact the CBM LNG projects were sanctioned on ambitious estimates of proved and probable (2P) reserves, not just the proven reserves that underpin conventional LNG projects,” he said.

EnergyQuest noted that Santos GLNG had already negotiated down its offtake contracts from 7.2mn mt/yr to 6mn mt/yr and is yet to reach even this level. In 2018, Queensland projects shipped record 20.57mn mt of LNG from Port of Gladstone, up 1.7% year-on-year.

G3 finds value in Chinese CBM

While China is importing LNG, it is also fostering domestic gas production: exporting money weakens the economy while indigenous gas output saves money and adds value through jobs and taxes. The government realises that China is going to be the world’s largest importer of gas. To limit that, it wants reliable supplies of domestic gas.

G3 CEO Randeep Grewal, a long-standing advocate of coalbed methane production (CBM), has been in China for 20 years, outlasting other foreign producers. He explained his business model to NGW in an interview during IP Week.

G3 subsidiary Green Dragon Gas (GDG) is producing 15bn ft³/yr under two production-sharing contracts from less than 5% of its acreage, but its infrastructure can handle 55bn ft³/yr. It produces gas from its GSS and GCZ blocks in Shanxi Province, where overall the initial gas in place estimates are over 3.45 trillion ft³. GDG holds 47% of GCZ and 60% of GSS, where it partners state enterprises.

“The central government is crystal clear on its commitment to bringing domestic gas molecules as quickly and sustainably and in as great quantity to the surface as possible,” he said. “The Chinese government is very pragmatic: it does not want taxes from us, it wants us to continue to invest underground. Assets this large need stability. And we receive a direct cash subsidy on every molecule sold, which is close to the cost of production (about $2/’000 ft³, which is about a quarter of its average sale price).”

He is a keen fan of CBM, calling it the most sustainable and purest of all hydrocarbon resources. To produce it takes a lot of time and patience, but it is worth the wait: it is 99.9% methane. And GDG does not hydraulically fracture the beds as they do in Australia; instead the gas flows through the brittle seams. “If you put the well in the right location, it all seeps out steadily,” he says.

A consequence of that is a lengthy plateau rather than a spike and sharp decline in output. The most profitable market is power: GD runs a 10-MW plant on some of the output. Alternatives are selling it for the vehicle market and the least profitable is selling the gas into the pipeline network.

Decisions, decisions…

Predictions of gas shortfalls or gluts normally miss the mark for various reasons. That is all part of the fun with energy. One case in point is the slew of import terminals that were built in northwest Europe in the noughties and then left mostly idle for years. They were rebranded as ‘insurance policies’ while industrial decline and renewable energy hit gas demand. The expected LNG went to higher-paying markets elsewhere, leaving Russia and Norway to fill the void. Another case in point is the technological miracle of US shale gas output.

From 2014 through 2017, LNG buyers had increasingly been looking to sign shorter, smaller and more flexible contracts, foreseeing an era of oversupply. Shell warned in its 2018 LNG Outlook that this mismatch between suppliers' and buyers' needs would have to be resolved to enable developers to go ahead with new projects and so avoid the expected shortfall in the middle of the next decade.

And last year that warning was heeded with a slew of long-term contracts, some of which involved US terminals seeking offtakers. Venture Global is already very close to announcing a final investment decision for its 10mn mt/yr Calcasieu Pass terminal, having sold out capacity. It said mid-February that, with federal regulatory approvals in hand, it planned to start construction work “immediately”. On closer inspection however, the company is still waiting for US energy department approval to sell LNG to non-Free Trade Agreement countries before it takes FID.

On a larger scale, Qatar is expected to add a series of mega-trains to its plant, possibly with a partner to help out with the marketing. Although not yet at FID stage, this represents 23mn mt/yr capacity. Similarly, Novatek has informally at least taken FID on the 19.5mn mt/yr Arctic LNG-2 project; it has also talked of plans to build several similarly-sized further trains, and shareholder and partner Total has backed this plan.

Both these projects are politically driven: while also possibly making good commercial sense as the feedstock costs are so low, not much can stop them if Doha or Moscow will them into being. Between them they could bring 60mn mt/yr. Then too there is Saudi Aramco’s bid to become a major gas player, and in Russia, Rosneft’s ambitions also extend to LNG, although pipeline exports to Europe might prove easier to arrange, physically if no politically, given the spare capacity coming up in the Ukraine system. It expects its gas production to rise from 70bn m³/yr today to over 100bn m³/yr by 2022. It is also a shareholder in the Egyptian Zohr field, some of which output may be liquefied.